A New Era In Insurance: How insurtech meets the expectations of today’s customers?

A New Era In Insurance: How insurtech meets the expectations of today’s customers?

In the first part of my article series I covered how insurance business has evolved into an experienced-based model by offering digitally native propositions and rethinking the distribution of insurance.

Here are the key takeaways from Part I:

- To retain customers and grow market share, insurers have been depended on strong brand name, product quality and a competitive price but it is no longer enough for today’s customers.

- Putting customers at the heart of the business and adopting an ecosystem-mindset will be the key for insurance industry to capture the previously unimagined value through interconnected journeys and being digital.

- Digital holdouts are expected to continue the online behaviors they adopted during the pandemic and incumbent insurers need to realize the risk of pretending to be digitized by just delivering analog offerings digitally and providing unappealing services.

- To succeed in the long run, insurance companies need to rethink the full journey of insurance customers. Identifying ways to streamline policy issuance and claims handling with the right ecosystem partners is a start for being digital for most of the incumbents.

- Consumers are purchasing more services day by day as they enjoy the convenience and ease of online buying. Today’s technology allows insurers to embed services and products in new marketplaces that were not possible before with API and microservices based infrastructure.

Here are the next two themes focusing on rebuilding the trust through risk prevention services and ensuring data security in insurance industry.

3. Prevention Rather Than Protection/Payout

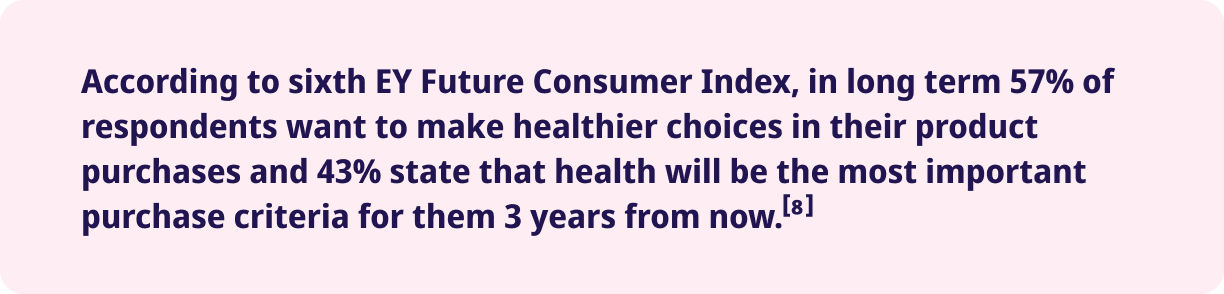

Customers’ concerns about health and safety have risen with the pandemic. Although it’s been two years since the onset, the impact of the pandemic on both lifestyle and well-being still continues, and people’s mental toughness is being tested in the face of health risks, fear of spreading the virus, economic challenges and work-home balance. Today, people are reassessing their priorities around work, health, and social life. The long-term high-level stress experienced by adults is affecting physical and psychological wellbeing seriously. The report from American Psychological Association (APA) reveals that many surveyed had experienced unwanted weight changes, poorer sleep quality, physical inactivity, higher cigarette, and alcohol consumption which is directly linked to substantial changes in lifestyles.[6] The growing interest towards protecting physical and mental health has become even more pronounced today. From wearing masks to using telehealth services instead of face-to-face appointments, consumers maintain preventative behaviors to protect loved ones as well as their own well-beings. By 2026, the global health and wellness market is expected to rise US$ 4.24 billion. [7]

Customers expect insurance companies to provide peace of mind and help them live as long, healthy and wealthy as possible while protecting against losses instead of just paying when an incident occurs. Evolving customer expectations make insurers to question the original reason for their existence, which is to provide risk management solutions. Insurance has always been seen to be an effective way to transfer and mitigate risks, but it is also becoming effective at limiting and avoiding them. The holistic understanding of customers and their environment will support the broader delivery of risk mitigation and services around prevention. In the long-run, life and health insurers must keep their eyes on supporting customers in multiple aspects of well-being and need to work with targeted partnerships.

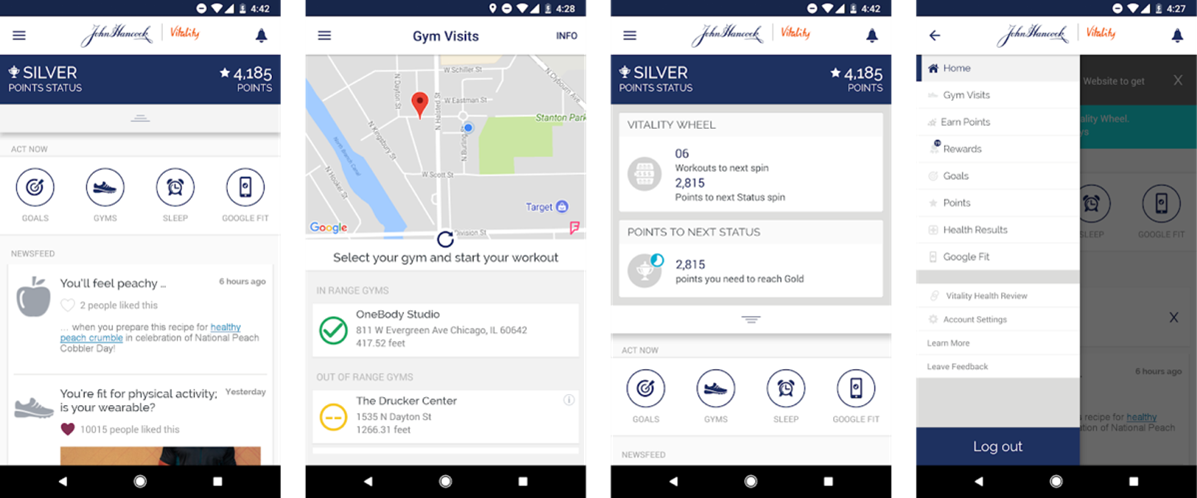

Vitality, a subsidiary of Discovery Limited, exemplifies the move toward proactive prevention in the industry. It disrupted the market with its shared value insurance model which encourages healthy behaviors with perks and premiums. While healthier behaviors result in a decrease in claims and an increase in margins for insurers, on the societal level it creates healthy society and reduce the burden on the healthcare services. Recently, Vitality and Rand Europe has announced a new calculator they developed which provides a personalized view of members’ lifespan, quality of their life and a list of possible diseases that will occur in the future. Based on the results, members can get suitable recommendations considering their age, gender, health status and current lifestyle choices to maximize the number of years they spend. Additionally, to motivate its members to earn physical activity points, Discovery has teamed up with Apple to offer fully funded Apple Watches. If members do not stay active, they need to pay a certain fee per month depending on the Apple Watch model. John Hancock, BBVA, Manulife, Generali and Ping An Health are some of the industry leaders who adopted this model and the outcomes are very impressive; 10% lower hospital admissions, 10% – 30% lower hospital costs and 15% – 20% higher life expectancy. [9]

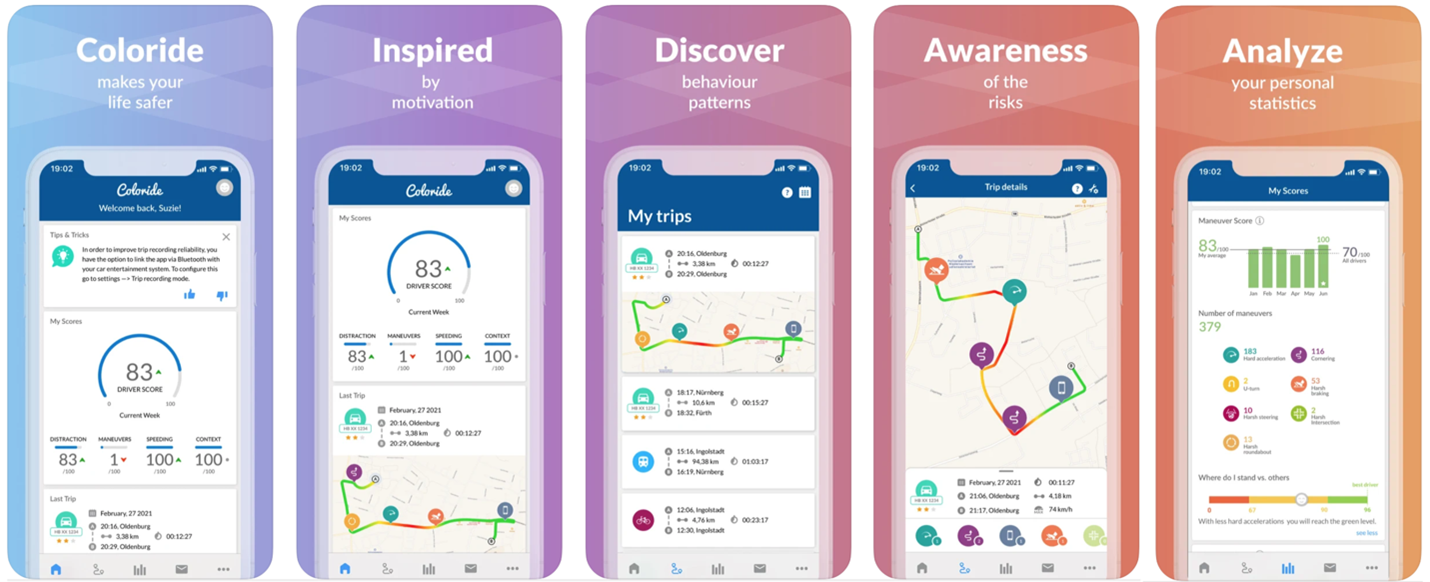

The same preventative attitude can be taken for automotive insurance as well by encouraging people to drive better and to be safer. Today the increased interconnectedness between devices and people has allowed to record more data than ever recorded. Data collecting has gotten considerably easier since most of it can be created, recorded, and shared automatically. With 5G technology and the vast quantities of real-time data available from connected devices that we own, the activities we engage in and the people we know, insurers can bring internal data and new external data sources together to understand how risk components fits together. Through the use of AI, insurers can discover patterns and relationships in large data sets and extract valuable insights from unstructured data.

4. Dealing With Cyber Threats

Today, every company on the globe is subject to potential disastrous losses coming along with electronic data breaches and cyber-attacks. Due to the pandemic induced remote working setups, businesses have had to quickly adapt digital approaches in their operations and services. Many believe that remote work is here to stay. Every day huge volumes of sensitive data are collected and stored in cloud storage services because of increased interconnection among businesses, suppliers, operations, and customers. It made it easier for attackers to get access to business networks and exploit any potential weaknesses. Volkswagen, T-Mobile, Socialarks were some of the companies which exposed to the biggest data breaches last year.

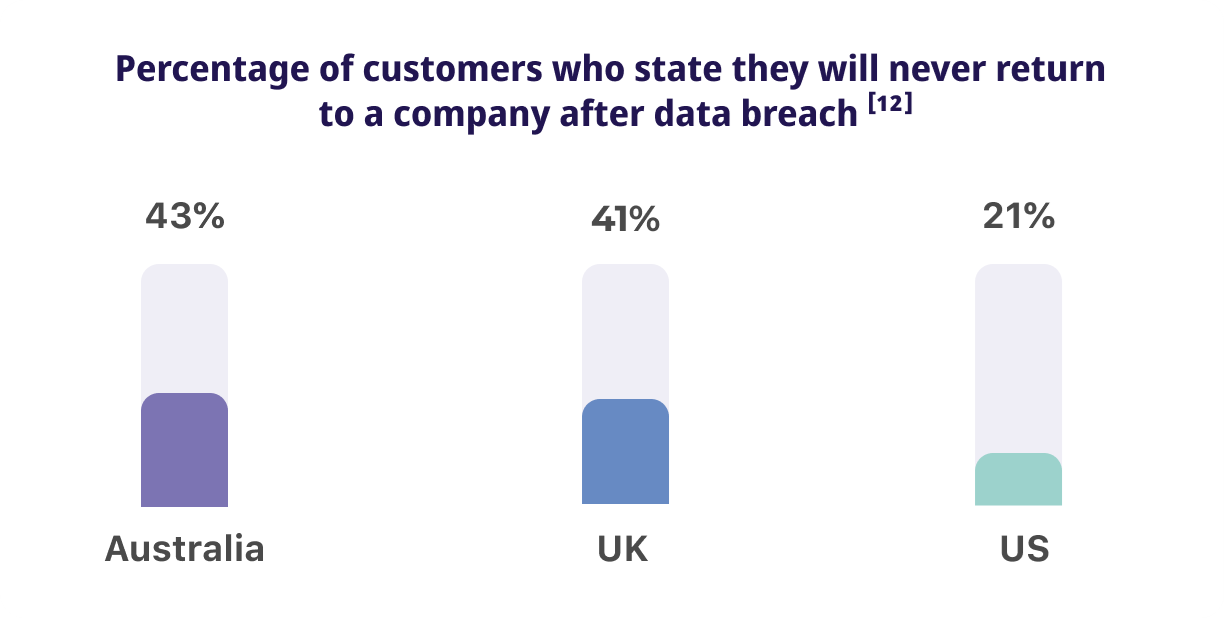

Insurance companies are also on the radar of cyberattacks as they consume, store, and transmit large volumes of highly sensitive policyholder data such as health records and business-specific information. As I mentioned earlier insurance customers are willing to share their data in exchange for limiting and avoiding risks as well as to get lower premiums. With a 19% increase compared to two years ago, about 7 out of 10 customers share considerable data on their health, exercise and driving habits with insurance companies [10] and this is expected to increase with 5G. 5G will contribute to unleash the full potential of IoT as it is at least 10 times faster than 4G and make it possible for devices to share data faster than ever. It is projected that by 2025, there will be more than 30 billion IoT connections, on average almost four IoT devices per person. [11] Connected devices are already triggering a sharp increase in digital footprint and enabling digital networking by instantly exchanging data across new ecosystems where some of the most serious security threats lie. As customers become more aware of the value of their data, besides expecting insurers to give good service and value for money they also require them to protect their data. Losing highly sensitive customer data would result in significant financial penalties for insurance companies and reductions in customer trust which is already low.

With the transition to remote ways of working and rapidly evolving threat environment, security experts have struggled to keep up with improving infrastructure. Of course, interconnected networks can be extremely complex, but it plays a substantial role in additional risks where companies are not always aware. Unfortunately, attackers have evolved faster than legacy systems employed by insurance companies. On the other hand, the financial implication for breaches on information systems has grown so much because of regulations like GDPR. According to recent IBM report, data breaches cost $4.24 million per incident on average, and it takes over 287 days for companies to detect it. While there might be direct costs there may also be significant long-term consequences for insurance companies such as reputational risk and cyber accumulation risk. Therefore, insurers must constantly invest and innovate to counter potential attackers.

For example, Munich Re is using their own sophisticated accumulation models to understand the potential impact of a single vulnerability on multiple companies. Understanding the company’s systems and value chain and doing regular vulnerability scanning are vital. Insurers may benefit from employing AI and machine learning to enable effective and quick detection of cyber threats. Since these technologies can analyze massive volumes of data rapidly and are suited for monitoring data flows, it can identify any deviation from an expected pattern. So that the threat can be avoided before any harm is done. Additionally, insurance companies are started to anticipate rather than react. They have adopted resilience-oriented strategies to determine ways to continue to operate in case of any attacks, to limit the breach impact and shorten recovery time. Security and data protection requirements are started to be included in third-party contracts of insurance companies and although it has been a challenge regular audits are carried out to ensure compliance. Providing ongoing cyber awareness training for partners and employees is equally important as they are susceptible to phishing attacks. Insurers must not only manage cyber risk within their organization, but they must also stay up with new threats for their value chain, which require cooperation among multi-disciplinary teams.

Although blockchain technology is not mature today, especially widespread adoption of it will provide new opportunities to secure sensitive data. The insurance industry is well aware of the great potential. To explore the opportunities, benefits and requirements that blockchain presents to the industry, The Blockchain Insurance Industry Initiative (B3i) is formed. There are now more than 40 industry investors in the community including incumbents such as Allianz, Aegon, AXA, Mapfre Re, Swiss Re etc. While the blockchain technology is still being debated in terms of infrastructure and regulations, it will definitely bring more security, transparency and immutability to operations. Ultimately, storing all forms of data in blockchain technology will establish integrated data with a single point of truth and will create opportunities for insurers to enhance their collaborations, operations and personalized services in a secure manner.

Final Words…

The pandemic has undoubtedly shifted the gear and accelerated the progression in digitalization of insurance industry. As the lines among work, social and lifestyle interaction have blurred consumers have become more reliant and connected to systems in more ways than it has ever been. Incumbents have been forced to reconsider their technical capabilities, product and service offerings to meet customers’ evolving demands. Over the next years, it is for sure that partnerships will be the key for disruption and become a lot more prevalent to restore the trust in industry and support customers achieving their personal goals and avoiding risks, for those incumbents that do not adapt will have much more difficulties to compete.

Resources

[6] https://www.apa.org/news/press/releases/stress/2021/one-year-pandemic-stress

[8] https://www.ey.com/en_gl/news/2021/03/ey-future-consumer-index-consumers-more-concerned-one-year-into-the-pandemic

[9] https://innovationininsurance.efma.com/discovery-2021

[10] https://www.accenture.com/il-en/insights/insurance/guide-insurance-customers-safety-well-being

Reading Time: 7 minutes

Don’t miss out the latestCommencis Thoughts and News.