The Mobile Banking Ecosystem and Super Apps

How have the super apps become an essential part of the user experience?

The Mobile Banking Ecosystem and Super Apps

How have the super apps become an essential part of the user experience?

Banking is one of the world’s oldest businesses, and as such the sector is more than a little stuck in its old ways. But like every business, banks that haven’t embraced digitalisation risk being left behind. Digitalisation and mobile banking are modern requisites to understand what customers want and need, on top of how to optimize the customer journey. Particularly post-pandemic, mobile banking and digitalisation is critical to being able to bring 21st century customers into the fold.

But basic mobile banking itself is quickly becoming a thing of the past. Super apps have become an essential part of the user experience for many banking customers (particularly those in Eastern and Southern Asia). But in many cases, the future is obvious, and it’s up to banks to make sure they can put the pieces together. So let’s start at the beginning and tell you a little bit about what super apps are and why they’re so important for the future of banking.

What are Super Apps?

The “super” part of Super Apps distinguishes them from either Multi-apps or single purpose apps. A super app is an app that allows you to perform a wide variety of tasks within a single app, which is critical for banking needs more than just about anything else.

So first let’s talk about what a multi-app is before we get to super apps. Think of the difference between something like Facebook, which has a different app for Messenger, Instagram, WhatsApp, and so on. Facebook is a classic multi-app, where you have multiple apps for every service it provides. WeChat in Asia is a classic super app, allowing its 1.2 billion users to do essentially everything from one single app. This includes allowing you to message, network, shop, and perform payments from just one app.

A single app with all of your financial information and the ability to use all forms of financial services safely and securely would obviously be incredibly convenient for users. If a banking app could provide any financial, leisure or lifestyle need for users, then that’s the super app that would grow beyond any other app we currently use in the Western world.

The Pros and Cons in Terms of Businesses and Users of Super apps

You’re still reading, which is a good sign that you understand how much super apps could change the world we live in, and how much they could offer customers. So let’s discuss the pros and the cons so you can make your own decisions about what the future has to offer.

What are the challenges to creating a financial super app?

We’ll start with the challenges to building a super app. Of course, the first challenge is simply that building that many functionalities into a single app requires some truly excellent development teams. Beyond that though, there are some challenges unique to breaking into markets in which super apps are not yet as ubiquitous as they are in much of Asia.

- Lack of a Vacuum

In Asia, there was a complete vacuum for an app-based financial service to move into. Credit cards were not as common as they are in Europe (WeChat was founded in 2011 and is widely seen as becoming the world’s first super app by 2018):

This meant that the ease of contactless payment enjoyed in much of the West in today’s markets is often taking the place of the ease of payment over a super app in Asia. In fact, Apple Pay and Google Pay also offer contactless payment, meaning there are preexisting convenient methods of payment that a super app must contend with in the West. Neither credit cards nor Apple/Google Pay offer even close to the types of services available to a super app, but the point is that there isn’t quite the vacuum in the market as there was in Asia.

- Data Protection and Privacy Laws

This runs a couple ways as well. First of all, Asian super apps benefited from being at the forefront of the movement, so that the awareness of data protection issues and the media firestorm around them hadn’t quite hit the mainstream media yet.

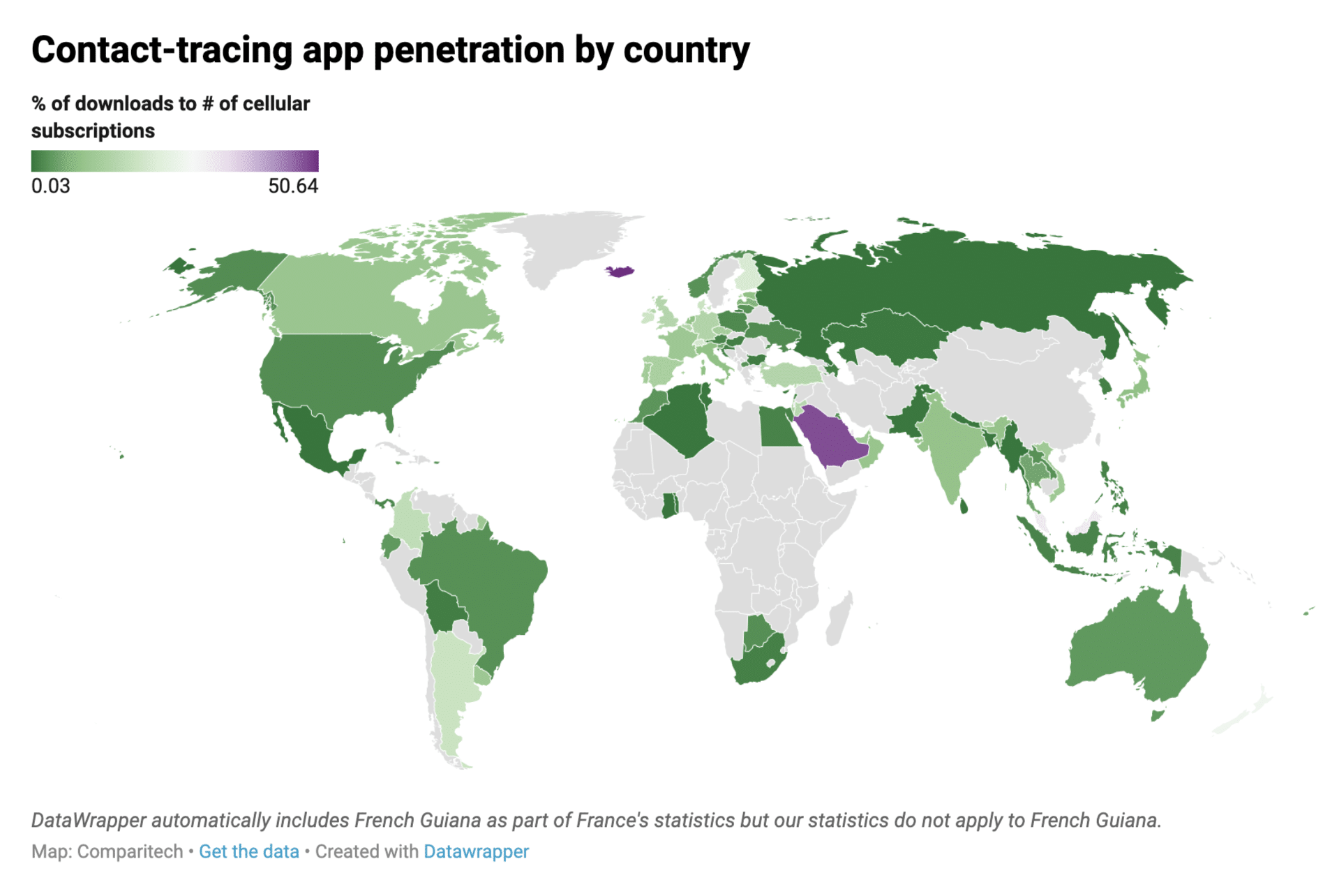

But more than that, there is some evidence that Europeans are simply less likely to trust their own governments – or any private service – to provide the levels of protection and security that they require. During the pandemic, most countries offered contact tracing apps for people to follow and download for their own health, and Europe performed notably worse than most other countries in the dataset:

It is hard to imagine how Europeans would feel regarding their financial security when using a private app if they were unwilling to download all the necessary health apps.

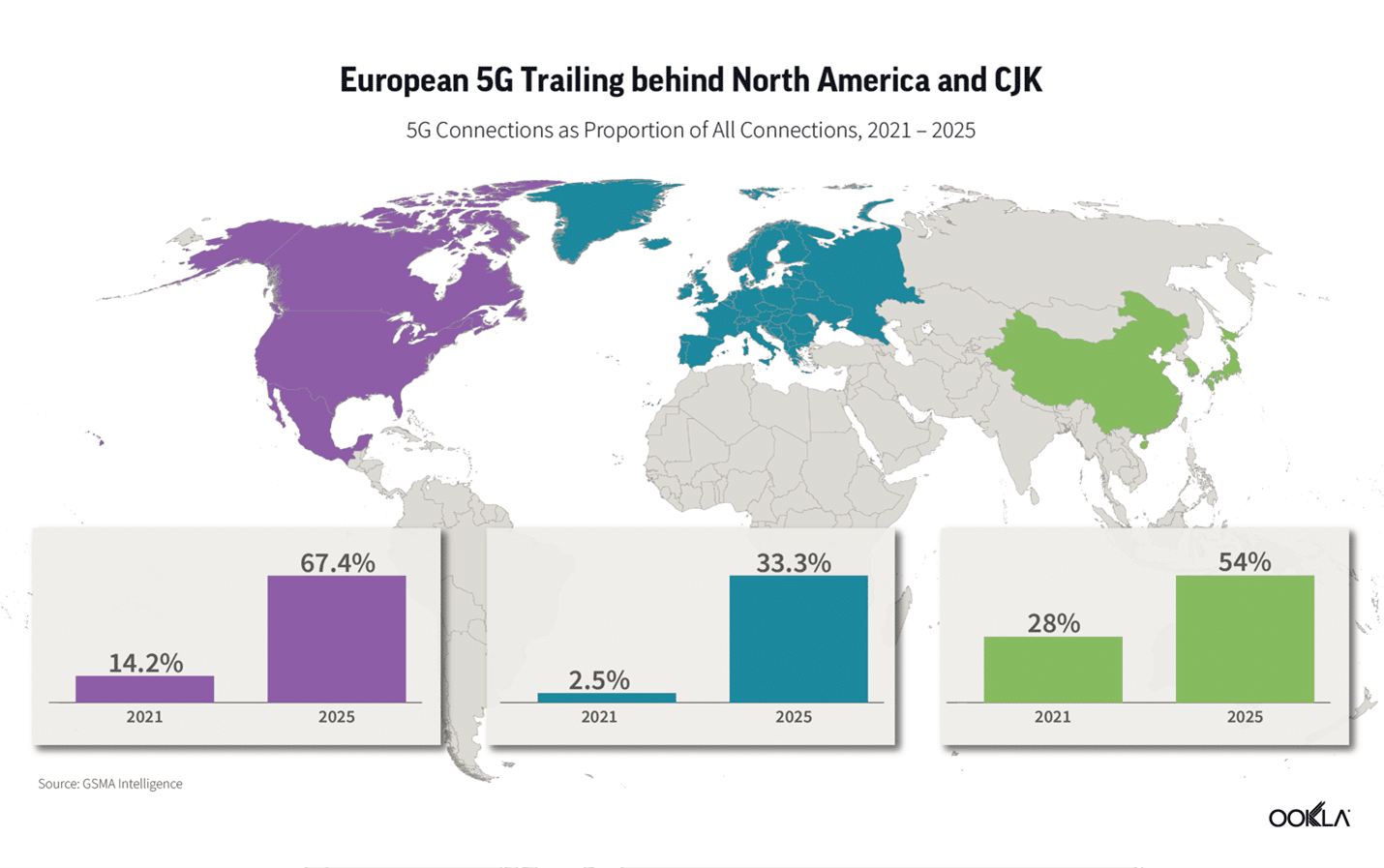

- Surprisingly Poor Technological Infrastructure

While Europe and America are often seen as being at the forefront of global technology, they’re actually well behind Asia in most respects. Cell phone coverage is often spotty in rural areas, meaning that a large scale mobile-only payment provider would run into real structural issues in many regions throughout American and Europe, more so than they would in most of Asia.

- A Lack of Digital Integration

In Asia, almost all governmental records have been long-since digitalised. This simply isn’t the case in Europe, where it would be impossible for any app to simply place education, health and traffic records all under the same app because there isn’t already an e-government program that does that. Many governments in Europe, like Germany, have started this process, but there is no timeline available for when it would be made available. WeChat features all such information by accessing the Chinese e-government app, allowing users to, say, pay traffic fines in the same app in which they purchase widgets online.

- Stringent Regulation Requirements

The EU in particular is well known for fierce regulatory requirements, which any super app would need to contend with in order to grow its base. This means putting an app in every single local language, as well as stringent data protection policies. Gaining banking licenses, and just about all regulations are tougher in European markets, which again is another obstacle towards becoming a fully blown super app in the European market.

What are the Potential Benefits of a Banking Super App?

Clearly, there are a number of challenges posed into completely disrupting the way banking and payments are performed by the vast majority of users. But do the benefits outweigh the challenges? We’ve already stated our opinion: You see what’s happening in Asia already and it’s hard not to think that super apps are an inevitability given the ease of use and the convenience they bring to the consumer. But let’s break down that convenience a little bit into a broader discussion of the advantages.

- Ability For Consumers to Make Smarter Decisions

When people’s money is spread out all over the place, decisions require the expertise of different people in each field. Which insurance package is best for you – an insurance salesman is here for that! Which car fits your lifestyle best – a car salesman is here to help you! How much should you be paying in taxes – Don’t worry, an accountant definitely has your best interests at heart!

When all your financial data is centralized on one app, along with all of your behavioral and personal data, that enables the app to provide objective, data-focused recommendations to each individual user based on an algorithm rather than based on the kickbacks some salesman may or may not be getting as a result. Personalization of the entire process means that users can see the data for themselves and interpret it in a way that’s simply impossible in a complex world where every single financial statement comes from a different source, requiring a different set of expertise. Personalized service allows customers to form a better understanding of what they need, and to make smarter decisions as a result.

- Increased Customer Loyalty and Retention for Banks

Similarly to the above, so much of what traditional banks did was spend hours and hours of man-power and time on processing transactions, compiling data, building risk profiles, and broadly doing all the things we think of that goes on in the back office of a big bank. When all of that is automated, banks can instead focus on the consumer themselves, and building a relationship with them as well as build more successful brand awareness. The types of loyalty programs usually associated with marketable goods and services could all of a sudden be offered by the bank themselves, with personalized incentives to focus on the consumer. In short, the relationship could very simply move from impersonal to personal.

- An Increased Ability to Bring Personalized Goods and Services to Consumers

Without a super app, brands essentially fight for a user’s attention by who can be loudest and most visible. Every day, users walk by products that they’d fall in love with if only they knew they existed. Or they scroll through a myriad of apps – most of which they are not really interested in – rather than staying on the one that would give them what they really crave.

A single super app has the ability to understand a customer on a personal level, and offer them tailor made products and services under the app they’re already focused on. A centralized app allows brands to bring products just to the consumers who need them most, making both businesses and consumers happier.

- Reduction in the Cost of Product Development

When everything is centralized into one app, no longer do different products need to be developed for different departments. This means that product development can be significantly less costly than traditional bureaucratic banks require.

- Convenience for All Involved

This is the summation of the benefits of a super app, the ease of access to one place. It’s endlessly convenient for users, who aren’t forced to trust every brand, or every business with which they associate. All businesses are connected to one trustworthy app and their financials are all under one roof.

Examples of Super Apps Trying to Break into the Market

As we’ve outlined, there is still a gap in the market in most of the world outside of Asia. There really is no equivalent to WeChat, which means that a banking super app is perfectly poised to become exactly that. WeChat started out as a social media platform and developed into a super app. Uber began as a car hiring service and attempted to become a super app, though frankly it doesn’t appear likely to be successful. Some app, from some sector, will eventually become dominant in other parts of the world. It remains to be seen from which sector and the bet here is that banking is perfectly positioned. But first, let’s look at who’s tried to do what so far.

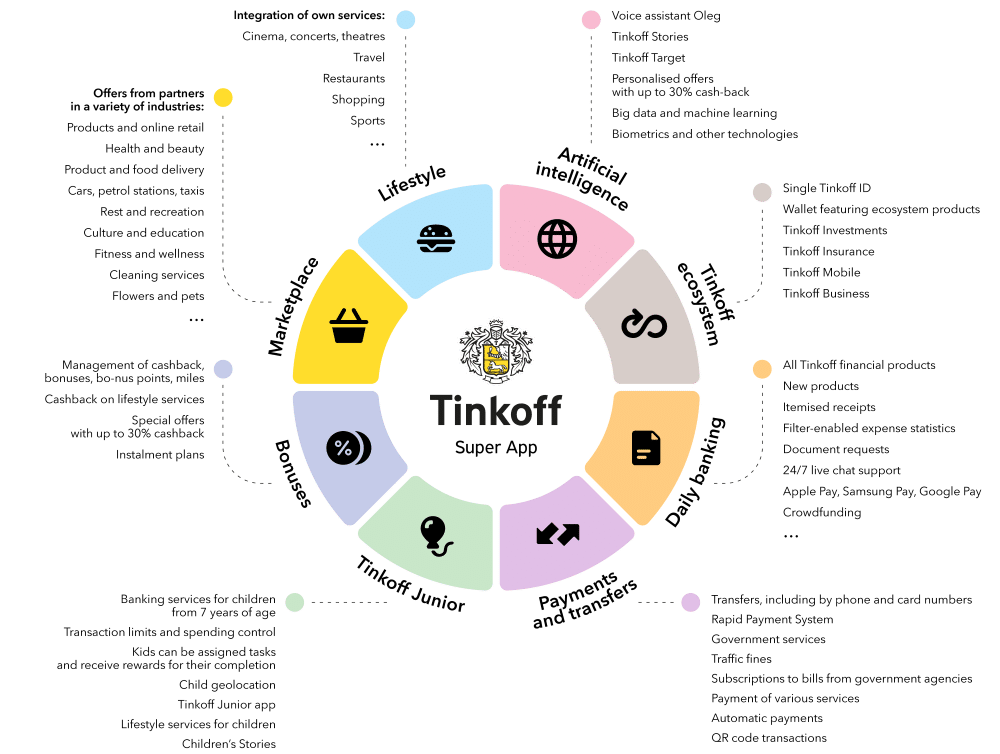

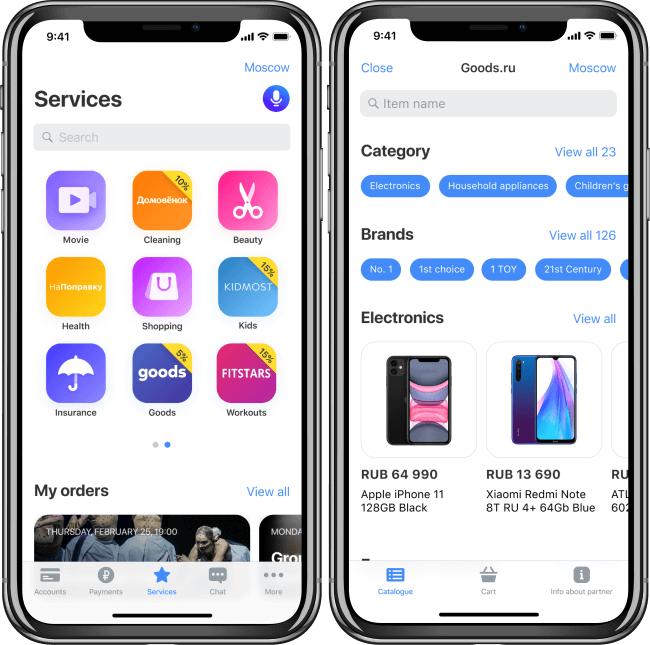

1. Tinkoff

Tinkoff is the fastest growing financial app in all of Russia, with over 20 million users. It allows users to perform standard banking app activities like daily banking, payments and transfers. But it also offers bonuses like cash back, it offers Tinkoff Junior for kids, and showcases merchants’ offerings like health & beauty, food & delivery, ride-hailing, entertainment, culture & education, fitness, cleaning, and much more.

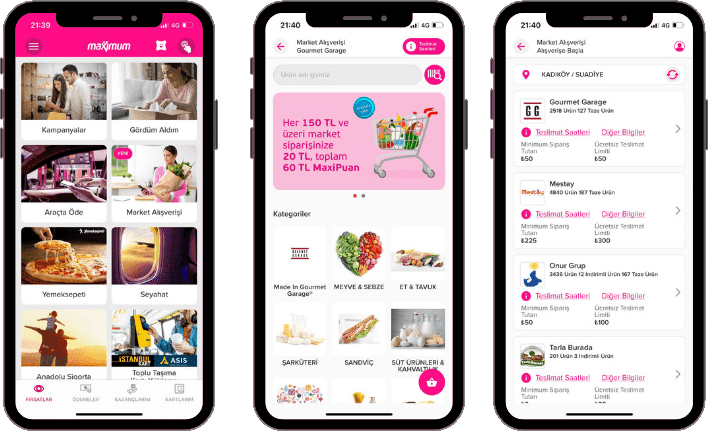

2. Pazarama

This is the Turkey’s largest private bank İşbank’s app, which is attempting to enter into the super app field. It allows for online food ordering, grocery shopping, and e-commerce by partnering with other apps, on top of its standard banking services.

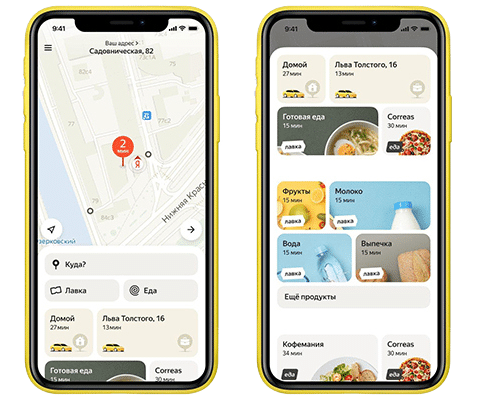

3. Yandex Go

Yandex Go is essentially trying to start where Uber has left off, bringing together on-demand transportation tools into one app. This means taxis and car sharing come together along with general transportation routes and services.

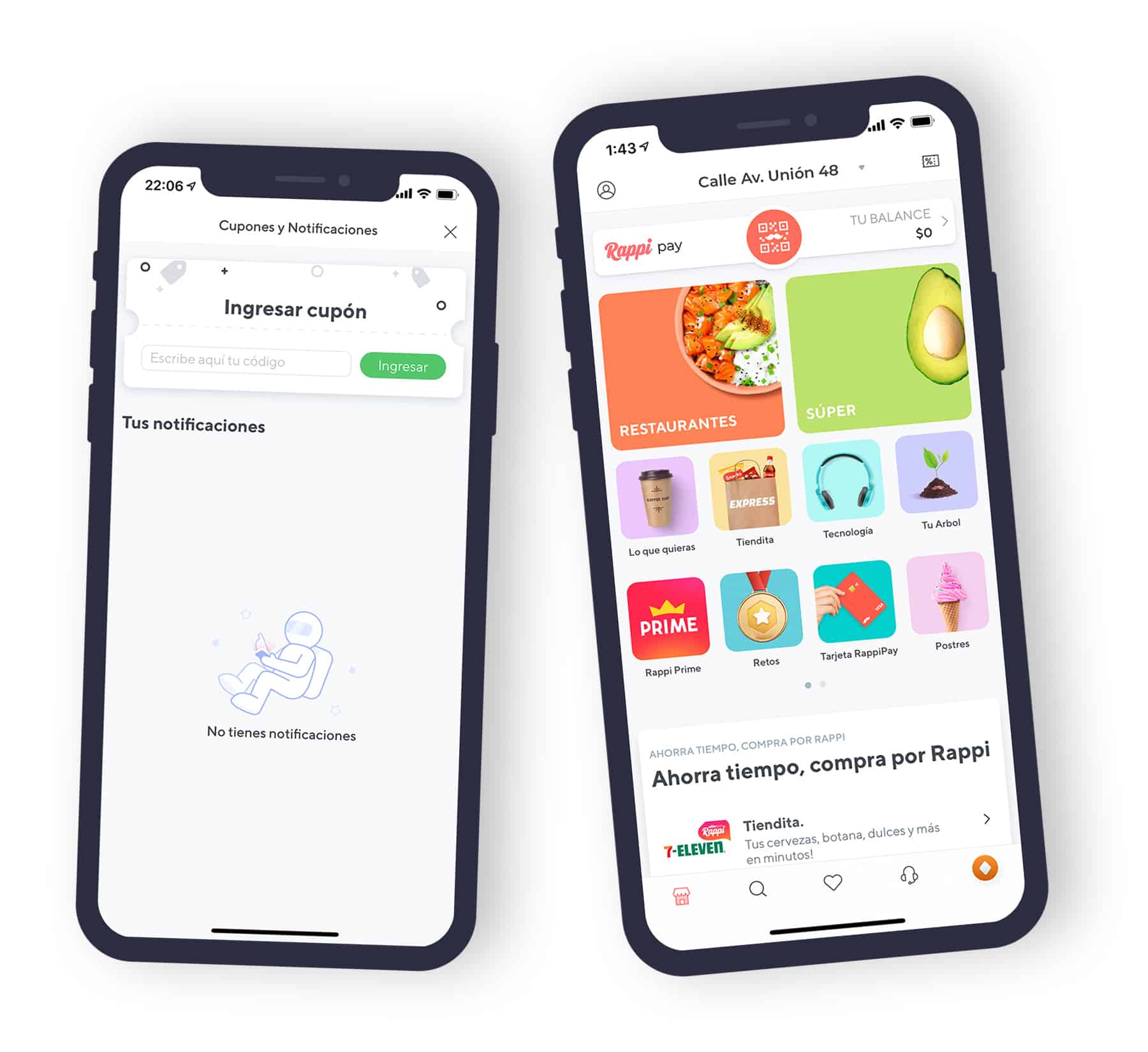

4. Rappi

Rappi is attempting to take over the Latin American super app market. It started out offering food delivery, though now has moved into providing payments, p2p transfers, movie tickets, e-scooter services, and anything else from finding someone to walk your dog to buying clothing. Rappi is well on its way to becoming the Latin American equivalent of WeChat.

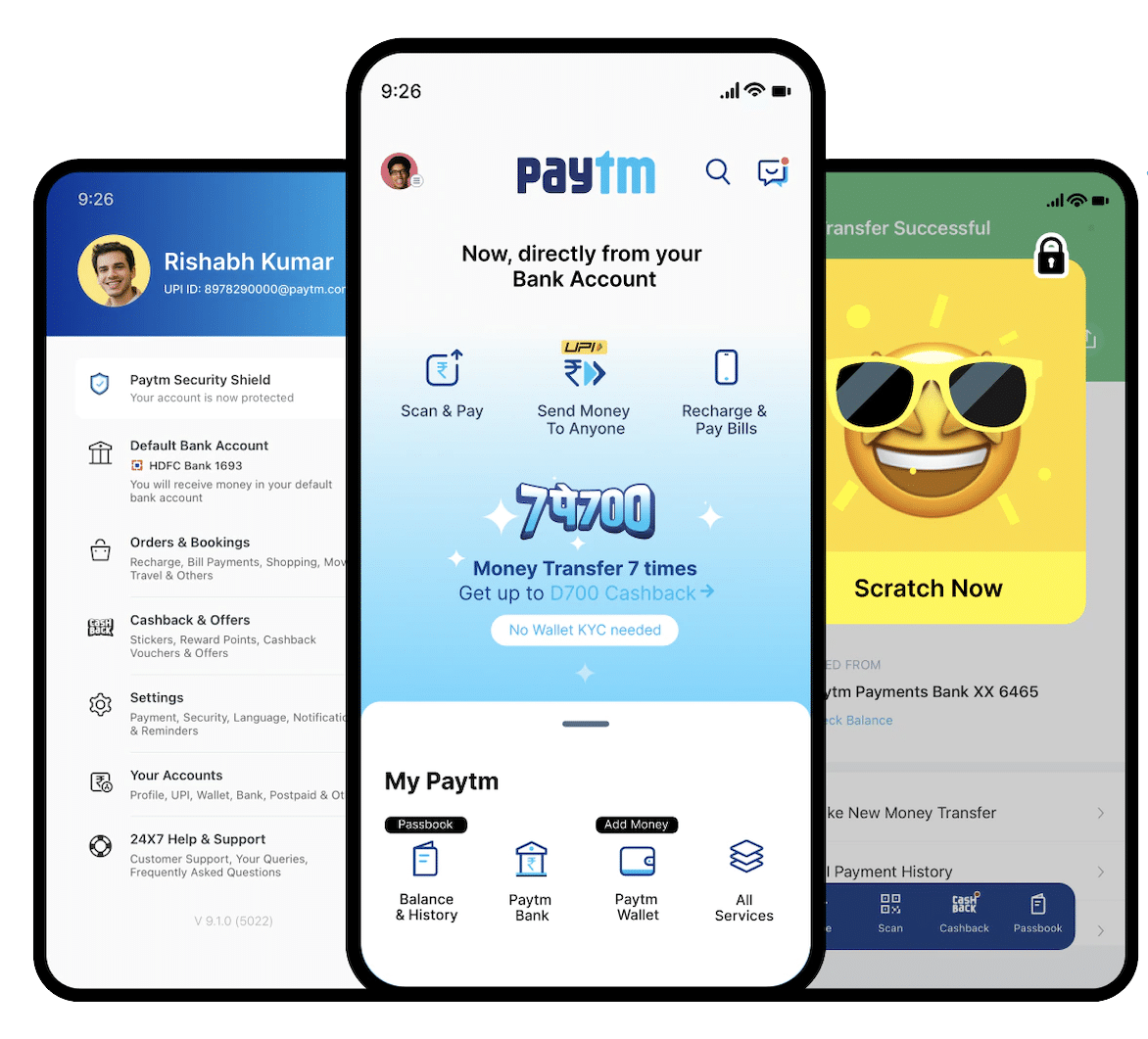

5. Paytm

Paytm in India is explicitly attempting to replicate what WeChat is to China, only as a fintech and financial services firm. It now has almost 80 million transactions a month from its users, with staggering amounts of money being lent both online and offline.

Key Takeaways

The switch from markets to supermarkets meant a change from the days where you bought your meat from a butcher, cheese from a cheese monger, fruit from a fruit stall, etc. Now, we all shop at supermarkets where everything we want is under one roof. So too is the switch from apps to super apps. We all know the days of having dozens of pages of apps in our phones, and switching between them all to get your work (and pleasure) done for the day. Super apps are the next evolution in that process, having all your work (and pleasure) under one roof in one easy-to-use app. The super app trend has already been caught by successful Europian financial apps like Klarna, Revolut, and Lydia, all of which are aware of such user behavior.

There are some pros and cons to developing a super app, including the difficulty in development and the challenges of dealing with regulation. However, what we see in Asia and the beginning of super apps like Paytm or Tinkoff is that there is a growing demand in the market for a super app amongst users. Given that WeChat simply started as a social network, or Rappi’s as a food delivery service, we see that the path to becoming a super app can be variable. What is certain is that it needs buy-in from the financial sector, where users have access to their banking information to pay for any and all kinds of services, on top of their usual banking needs.

Banks may risk falling behind the trend if they don’t develop a super execution or market strategy. Now, thanks to the ability to make payments easily from a single app or digital wallet, many financial applications are approaching the ability overtake banking apps.

If we see anything from the rest of the world, it’s that the development of these kinds of apps is inevitable. It’s just a question of where it’ll come from, and where that buy-in will be. The banking sector is ripe for developing its industry and bringing banking into the next century.

Reading Time: 9 minutes

Don’t miss out the latest

Commencis Thoughts and News.