The Future of Banking Depends on Personalisation Through AI

The shift in focus from the “product/service” to the “customer” has long been a top priority for companies, especially in the banking industry. Needless to say, when it comes to customer experience, customer personalisation plays a role in creating relevant and unique experiences. Through the use of big data, personalisation provides businesses with the opportunity to improve their customer lifetime value, as well as attract and retain customers.

Reading Time: 4 minutes

Don’t miss out the latestCommencis Thoughts and News.

11/07/2019

Reading Time: 4 minutes

The shift in focus from the “product/service” to the “customer” has long been a top priority for companies, especially in the banking industry. Needless to say, when it comes to customer experience, customer personalisation plays a role in creating relevant and unique experiences. Through the use of big data, personalisation provides businesses with the opportunity to improve their customer lifetime value, as well as attract and retain customers.

Don’t miss out the latestCommencis Thoughts and News.

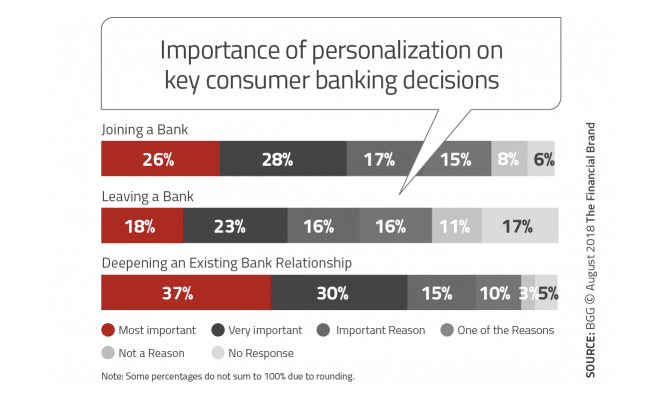

In order to be a step ahead of their competitors, banks need to implement an effective personalisation strategy in a scalable way. The image below from “The Financial Brand” says it all: Now is the time for banks to step up their game and provide customers with what they really want.

Let’s see how banks can elevate their customer personalisation journey with digital marketing engagement tools utilising big data and artificial intelligence.

Amazon-Like Banking: Is It Possible?

Until recently, there were limited capabilities, technologies and tools to execute personalisation strategies. When big data really started getting “big”, institutions found it challenging to truly utilise such a vast amount of data.

However, big data, advanced analytics, artificial intelligence (AI) and machine learning (ML) techniques have now reached the level where effective and large-scale personalisation is possible. Particularly for the banking industry, who are seeking to be competitive now and into the future, this means that personalisation is no longer an option – it is a must. But is this achievable?

Yes. In order for banks to provide the best personalised journey for their customers, they must use the right tools and technology, as well as build their marketing, sales and customer retention strategies accordingly.

Providing a personalised journey starts with Data Analytics

In order to provide relative and insightful customer experiences, banks need to utilise big data to their full extent. That means they need to track, understand and analyse every single interaction through data analytics.

Big data analytics enables banks to analyse customer data such as location, demographics, lifestyle, and personal preferences. More specifically to the banking industry, behavioural data such as transaction history and behavioural patterns/trends can also be analysed. This is where things become more sophisticated, so let’s break it down.

Next Step: Data Interpretation & Taking Action

Targeting and Segmentation Through Artificial Intelligence

Data analytics, of course, doesn’t provide a personalised experience to bank customers alone without interpretation. Utilising customer insights gained from data analytics is only possible with the right segmentation and targeting strategy. Creating advanced behavioural segments (where user patterns and behaviours are tracked and analysed) enable banks to build unique customer profiles. Grouping and targeting these customers with relevant communication at each touchpoint during the customer journey ensures an effective and simplified marketing strategy. At this point, it is also very important to provide a seamless omnichannel experience to customers by tracking customer analytics across all branded channels such as call centres, the website, mobile app, live chat, and more.

The integration of data analyses into digital marketing and engagement strategies, in combination with the right customer segmentation strategy, will mean that banks can:

- Analyse and identify the most common problems customers face.

- Identify if a customer is about to cancel their credit card by tracking similar patterns of other customers (in the same segment) who have already cancelled their credit cards.

- Take real-time marketing actions, such as offering a personalised promotion (e.g. to those who are about to cancel).

- Offer customers the optimal personalised journey through real-time and self-learning models. Banks can identify which personalised experience their customers will find useful in real-time. For instance, banks can send a tailor-made recommendation to an indecisive customer during their shopping journey to help them make a purchase decision.

In addition to acting in real-time, banks can also be one step ahead of their customers and competitors with the help of predictive analytics. This will allow banks to foresee any future issues and resolve them even before a problem occurs.

Don’t Forget to Measure: Metrics That Impact the Bottom Line

In order to create a sustainable and successful user journey, banks need to measure the effectiveness of their digital products, marketing campaigns and end-to-end customer experiences. In the long run, this will drive efficiency, customer acquisition, brand loyalty and profitability to new heights. This can be easily achieved with an integrated centralised platform.

Unified Database With Endless Possibilities

In order for banks to achieve long-term success, they need an integrated solution that manages data analysis and interpretation, as well as a smart marketing platform that can perform immediate and automated actions. As deeper insights lead to increased customer satisfaction, the benefits of having an AI-powered centralised platform are nearly endless. Insights from customers’ personal and transactional data can be used to better understand their financial standing. With access to such knowledge, banks can offer their customers personalised guidance to improve their finances.

This can be achieved through a platform where consistent communication is performed throughout the customer journey. Throughout this process, customers should ideally receive messages based on their transaction history, personal profile, and marketing preferences. As a bonus, they may be given the option to control the timing and channel of marketing messages they receive. This can range from a home loan to a credit card payment pattern made at approximately the same time every month!

Conclusion

Automation and advanced analytics techniques through AI can have a significant effect on how banks deliver personalised services to enhance customer experiences. Banks can leverage the benefits of AI to better understand customer issues, personalise and customise banking solutions, and reduce lead times when solving customer queries. The banks of the future will compete and win on who delivers the most relevant and personalised experiences.

Information on digital personalisation and Artificial Intelligence is within the reach of many organisations today. Consumers want brands to know them, understand them and reward them as an individual. Banks and credit unions can build trust with consumers by providing value-packed financial solutions that address their specific needs or are driven by their real-time behaviours.