Evolving insurance needs in the age of "instant everything"

Evolving insurance needs in the age of "instant everything"

The insurance industry was perhaps not the first industry people predicted would be completely revolutionized by the digital age and the way smartphones have become so widespread will change insurance forever. But with the new world brought on by COVID-19, insurtech and a new insurance order are here to stay.

The ubiquity of smartphone usage has coincided with a rise in belief that every person has the right to insurance (particularly in countries like the United States where mandatory insurance is a relatively new policy). What this means is that people want insurance for a wider variety of activities – from new forms of rental (as AirBnB becomes more common) to new forms of driving (ditto with uber or ridesharing) – and they want to be able to access that insurance immediately.

On top of that, the COVID-19 pandemic means that not only do people want their insurance immediately, but they want it done with a limited amount of personal interaction or contact. Gone are the days of going to an insurance office, filling out reams of paperwork and paying with checks or cash. Now, payments have to be digital and access to insurance plans and networks have to be done digitally by accessing agency portals or through end-user insurance apps.

The fast paced world we live in and digital customer connection points that matter for insurance companies

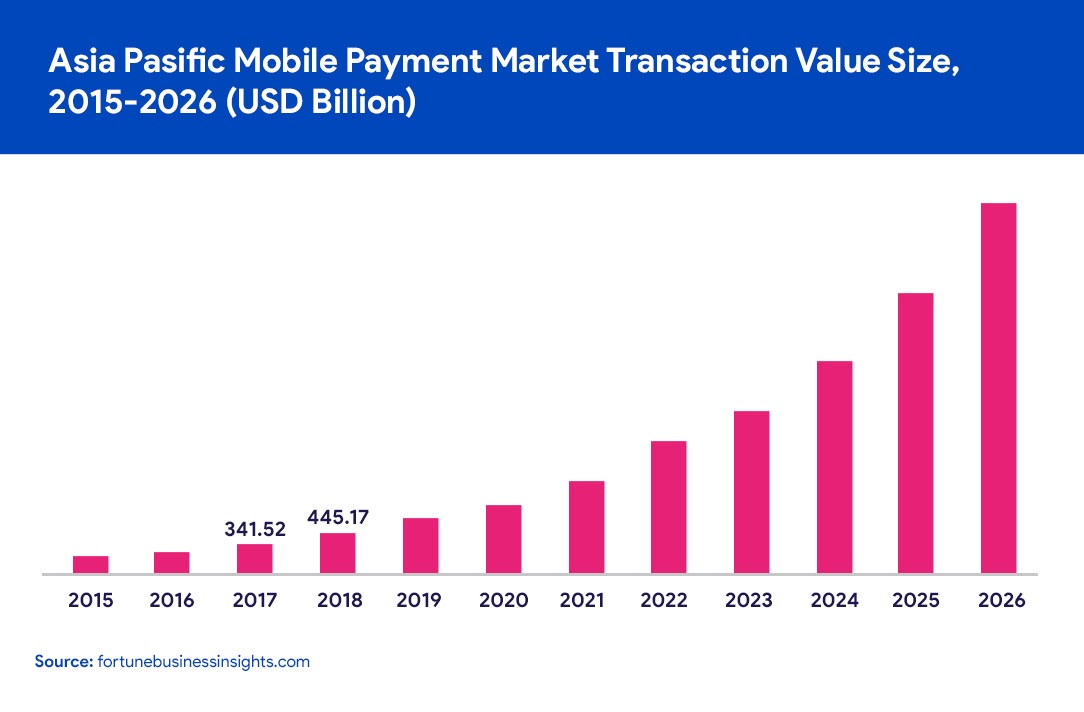

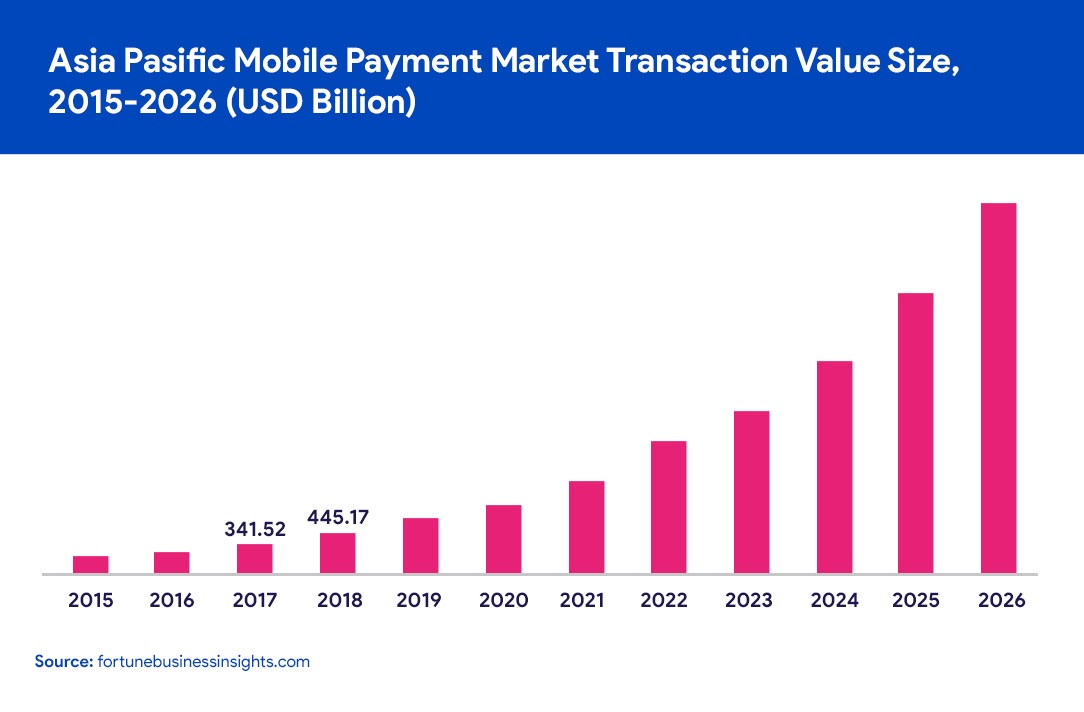

The fast growing global economy has seen the ownership of mobile phones, specifically smartphones, become an integral part for many people in their everyday lives. The driving growth of the mobile payment market is a result of the increased smartphone and internet usage all over the world.

Why insurance needs evolved during the past few years?

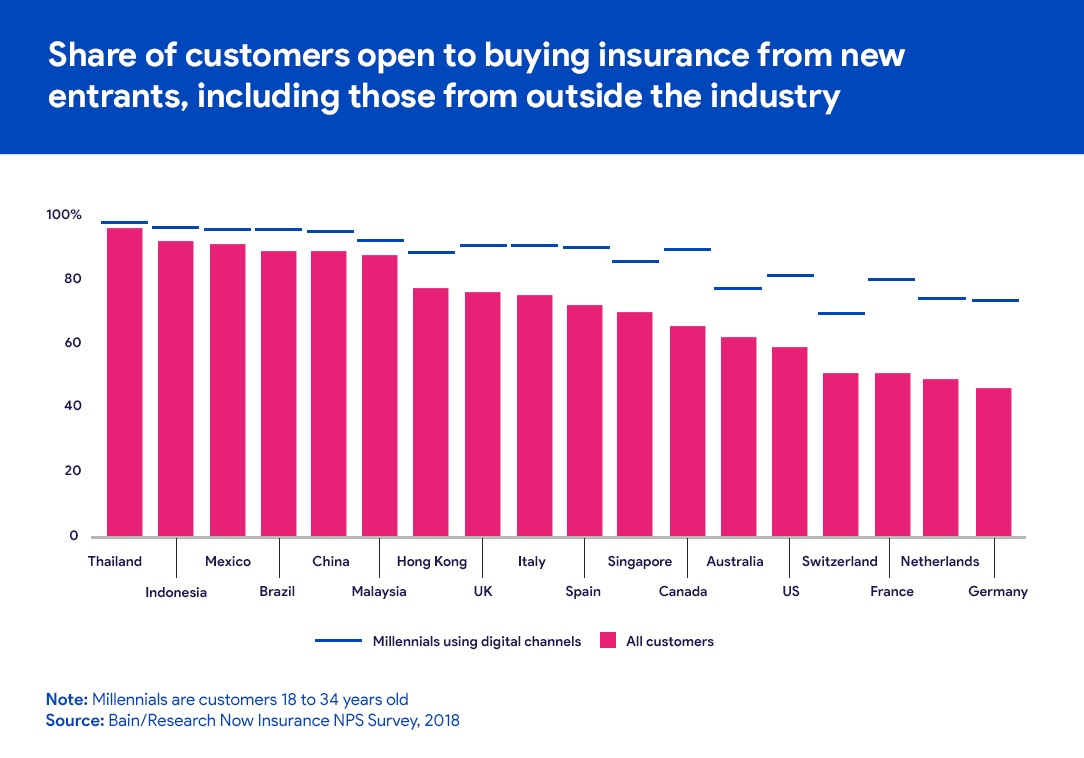

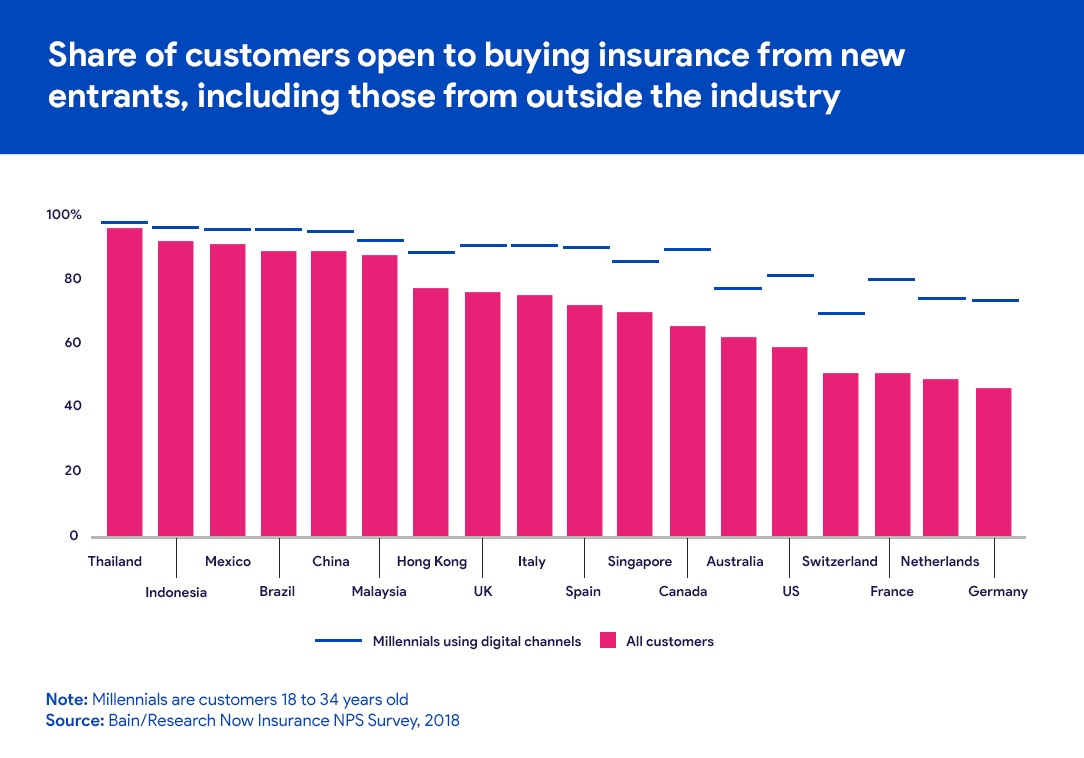

Insurance needs have also evolved recently. Regulators have worked hard to ensure consumers are protected from shady insurance practices. With the internet now at our fingertips, consumers have access to great deals and are able to compare prices and coverage. The ready availability of data analytics has also changed the way insurers price out their policies. The lifeblood of insurance is data. Companies are now able to get an insight into which risk to write and at what price. Leading market players need to digitalize the core of their business so they can meet customer expectations when it comes to speed and efficiency. Insurers have to work toward a goal of establishing purely digital, “no touch” operations.

Emerging trends in the Insurance industry are a combination of business and technology themes, most of which are likely to become mainstream in the near to long term. The industry that is evolving at a fast pace in the face of challenges and opportunities put forward by changing customer demands.

Given their lower operational costs and faster speed to innovate, they bring new and relevant propositions to the customer faster. With the rise of sharing economy, newer channels of distribution and self-service revolution will increase product innovations & enhance digital initiatives to maintain existing customer base and win new ones. Technologies that are similar to Internet of Things, Cognitive computing and Blockchain are ready to transform the entire insurance value chain that will benefit both the customer and provider.

How to know which and how much insurance customers want?

Insurance customers don’t have complicated needs. The days of customer loyalty and complacency are gone. These days, the ability to research, compare, engage with, purchase from and have ongoing access to their favourite brands, is what people want. No matter where they are or at what time of the day. Both on and offline from their preferred device. People want to be able to choose between automation and human representatives, preferably one who can communicate well with a pleasant blend of empathy and humour. Many think that being environmentally and socially responsible plays a big part in their choice. Here are a few key factors:

- Clear and transparent information.

- Smooth and hassle-free interactions.

- Help to elevate anxiety while filing a claim after an accident/ theft or injury.

- To be provided with additional services such as roadside assistance or advice on leading healthy lives.

- The ability to be flexible; Similar to subscribers in the telecoms industry, policy holders want monthly termination options and deadlines.

This applies in particular to pension management. In Europe in particular, where pension management requires acres of paperwork and bureaucracy, a digital upgrade through agency portals and end-user insurance apps would make everything much easier. SAAS (software-as-a-service) platforms can combine insurance agents, companies, providers and employees, making changes to plans (such as relocation or updating marriage status) as easy as the push of a button. Industry professionals reckon that these kinds of platforms reduce costs of pension management by as much as 80%.

These portals mean that all your personal information is in one consolidated location, so you can make new decisions and changes quickly and everything else will update along with it. This, by definition, is clearer and more transparent as well as smoother and hassle-free – all necessities in the digital age, as listed above.

With MAPFRE, we really put these principles into practice. First, with MapfreGO, we created a digital channel for the end user to enter directly. From there, both insured clients and non-customers can acquire information regarding MAPFRE, its insurance products, and solutions, in addition to information regarding the network of distributors and professionals.

We also created the MAPFRE Agency Portal, which provides agents with the ability to renew their customers’ insurance policies by offering automatically calculated quotes, saving time and money on either agents or endless paperwork. This portal also serves as a communication channel between the head office and agents.

All of this allowed MAPFE to enhance the agent experience, increase operational efficiency, improve communication between headquarters and their sales networks, and provide a better customer service.

On top of all this, the COVID-19 pandemic is wreaking havoc on insurance companies the world over. With more likely to come before a vaccine or treatment is eventually found, some of these changes are here to stay and the insurance landscape will have to adapt accordingly. See the link for a complete report on the issue from Commencis.

Key Takeaways

With COVID-19 on our doorstep and the fast growing use of mobile technologies and the sheer comfort of personal anonymity, financial services that want to still have a hand in the game need to be able to be flexible and easily accessible.

What this all means is that the insurance industry is in the process of changing forever. Consumers no longer are satisfied with an insurance industry in which you have to meet with a representative in person to decide your plans, and that any changes you make therein require the same amount of time and paperwork (as well as payment plans that require similar amounts of time and energy). Now, consumers require insurance companies to be flexible in the kinds of plans they offer, they need those plans to be instantly accessible, and they need payment to be equally easy. This means that insurance companies are forced to open their own portals and apps through which consumers can access their insurance plans and manage their pensions, and through which they can change and update those same plans in comprehensive, secure, and transparent ways.

All of this is happening as we speak and as consumers themselves become more and more used to sorting through the world on their phones, it only makes it more of an imperative for insurance companies. The Coronavirus pandemic has meant that interpersonal interactions are themselves not just unnecessary, but actively dangerous (potentially). Digital insurance, as a result, is here to stay and will only become more and more ubiquitous moving forward.

Reading Time: 9 minutes

Don’t miss out the latestCommencis Thoughts and News.

Cem Çakır / Senior Project Manager

17/08/2020

Reading Time: 9 minutes

The insurance industry was perhaps not the first industry people predicted would be completely revolutionized by the digital age and the way smartphones have become so widespread will change insurance forever. But with the new world brought on by COVID-19, insurtech and a new insurance order are here to stay.

Don’t miss out the latestCommencis Thoughts and News.

The ubiquity of smartphone usage has coincided with a rise in belief that every person has the right to insurance (particularly in countries like the United States where mandatory insurance is a relatively new policy). What this means that is that people want insurance for a wider variety of activities – from new forms of rental (as AirBnB becomes more common) to new forms of driving (ditto with uber or ridesharing) – and they want to be able to access that insurance immediately.

On top of that, the COVID-19 pandemic means that not only do people want their insurance immediately, but they want it done with a limited amount of personal interaction or contact. Gone are the days of going to an insurance office, filling out reams of paperwork and paying with checks or cash. Now, payments have to be digital and access to insurance plans and networks have to be done digitally by accessing agency portals or through end-user insurance apps.

The fast paced world we live in and digital customer connection points that matter for insurance companies

The fast growing global economy has seen the ownership of mobile phones, specifically smartphones, become an integral part for many people in their everyday lives. The driving growth of the mobile payment market is a result of the increased smartphone and internet usage all over the world.

Why insurance needs evolved during the past few years?

Insurance needs have also evolved recently. Regulators have worked hard to ensure consumers are protected from shady insurance practices. With the internet now at our fingertips, consumers have access to great deals and are able to compare prices and coverage. The ready availability of data analytics has also changed the way insurers price out their policies. The lifeblood of insurance is data. Companies are now able to get an insight into which risk to write and at what price. Leading market players need to digitalize the core of their business so they can meet customer expectations when it comes to speed and efficiency. Insurers have to work toward a goal of establishing purely digital, “no touch” operations.

Emerging trends in the Insurance industry are a combination of business and technology themes, most of which are likely to become mainstream in the near to long term. The industry that is evolving at a fast pace in the face of challenges and opportunities put forward by changing customer demands.

Given their lower operational costs and faster speed to innovate, they bring new and relevant propositions to the customer faster. With the rise of sharing economy, newer channels of distribution and self-service revolution will increase product innovations & enhance digital initiatives to maintain existing customer base and win new ones. Technologies that are similar to Internet of Things, Cognitive computing and Blockchain are ready to transform the entire insurance value chain that will benefit both the customer and provider.

How to know which and how much insurance customers want?

Insurance customers don’t have complicated needs. The days of customer loyalty and complacency are gone. These days, the ability to research, compare, engage with, purchase from and have ongoing access to their favourite brands, is what people want. No matter where they are or at what time of the day. Both on and offline from their preferred device. People want to be able to choose between automation and human representatives, preferably one who can communicate well with a pleasant blend of empathy and humour. Many think that being environmentally and socially responsible plays a big part in their choice. Here are a few key factors:

- Clear and transparent information.

- Smooth and hassle-free interactions.

- Help to elevate anxiety while filing a claim after an accident/ theft or injury.

- To be provided with additional services such as roadside assistance or advice on leading healthy lives.

- The ability to be flexible; Similar to subscribers in the telecoms industry, policy holders want monthly termination options and deadlines.

This applies in particular to pension management. In Europe in particular, where pension management requires acres of paperwork and bureaucracy, a digital upgrade through agency portals and end-user insurance apps would make everything much easier. SAAS (software-as-a-service) platforms can combine insurance agents, companies, providers and employees, making changes to plans (such as relocation or updating marriage status) as easy as the push of a button. Industry professionals reckon that these kinds of platforms reduce costs of pension management by as much as 80%.

These portals mean that all your personal information is in one consolidated location, so you can make new decisions and changes quickly and everything else will update along with it. This, by definition, is clearer and more transparent as well as smoother and hassle-free – all necessities in the digital age, as listed above.

With MAPFRE, we really put these principles into practice. First, with MapfreGO, we created a digital channel for the end user to enter directly. From there, both insured clients and non-customers can acquire information regarding MAPFRE, its insurance products, and solutions, in addition to information regarding the network of distributors and professionals.

We also created the MAPFRE Agency Portal, which provides agents with the ability to renew their customers’ insurance policies by offering automatically calculated quotes, saving time and money on either agents or endless paperwork. This portal also serves as a communication channel between the head office and agents.

All of this allowed MAPFE to enhance the agent experience, increase operational efficiency, improve communication between headquarters and their sales networks, and provide a better customer service.

On top of all this, the COVID-19 pandemic is wreaking havoc on insurance companies the world over. With more likely to come before a vaccine or treatment is eventually found, some of these changes are here to stay and the insurance landscape will have to adapt accordingly. See the link for a complete report on the issue from Commencis.

Key Takeaways

With COVID-19 on our doorstep and the fast growing use of mobile technologies and the sheer comfort of personal anonymity, financial services that want to still have a hand in the game need to be able to be flexible and easily accessible.

What this all means is that the insurance industry is in the process of changing forever. Consumers no longer are satisfied with an insurance industry in which you have to meet with a representative in person to decide your plans, and that any changes you make therein require the same amount of time and paperwork (as well as payment plans that require similar amounts of time and energy). Now, consumers require insurance companies to be flexible in the kinds of plans they offer, they need those plans to be instantly accessible, and they need payment to be equally easy. This means that insurance companies are forced to open their own portals and apps through which consumers can access their insurance plans and manage their pensions, and through which they can change and update those same plans in comprehensive, secure, and transparent ways.

All of this is happening as we speak and as consumers themselves become more and more used to sorting through the world on their phones, it only makes it more of an imperative for insurance companies. The Coronavirus pandemic has meant that interpersonal interactions are themselves not just unnecessary, but actively dangerous (potentially). Digital insurance, as a result, is here to stay and will only become more and more ubiquitous moving forward.