BANKING

Next Generation

Finance Management

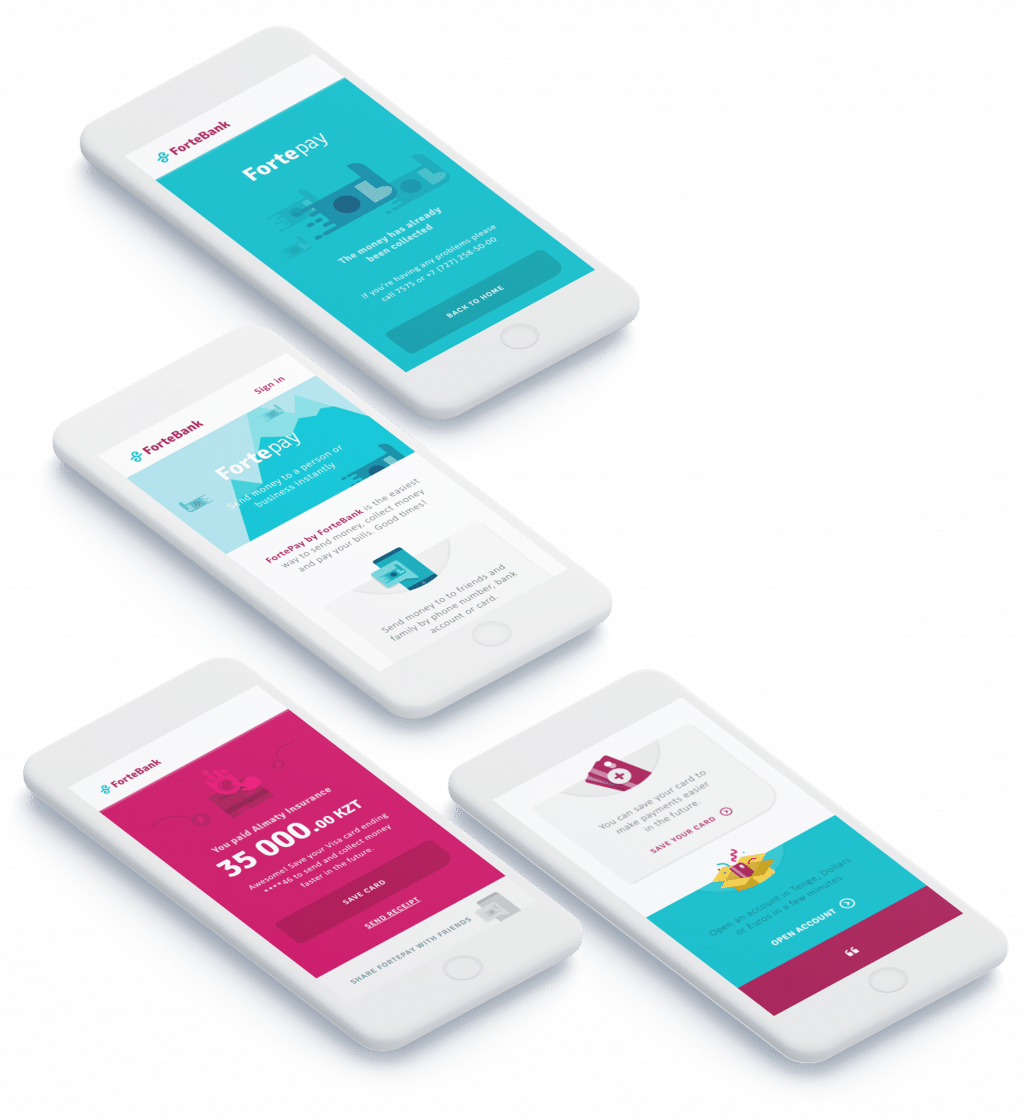

ForteBank is the fifth largest bank in Kazakhstan in terms of assets and has been providing the banking services for more than 20 years. Aiming to become the digital leader in a growing market, Forte partnered with Commencis to design and develop a mobile banking platform, primarily focusing on the retail market.

Challenge

Facing the necessity to evolve in a rapidly advancing technological landscape, ForteBank’s collaboration with Commencis led to the creation of an advanced mobile banking platform. The partnership focused on key issues in enhancing customer experience, integrating modern digital features like AR and chatbots, and introducing Apple Pay for seamless transactions. As a result of the study, ForteBank has been able to enhance its digital banking services in a rapidly evolving market.

Our Work

Strategy

Design

Development

Testing

Research

Key functionalities

Simply download and register

Anyone can register and use the ForteBank application without being a customer of ForteBank. Simply by downloading and registering online, the application enables its users to transfer money from card to card and pay for the services for more than 300 providers. Users can also send money to a mobile phone number and receive money for a card or withdraw cash without the need of a ForteBank ATM card. ForteBank application enables its users to set auto-payments for more than 100 service providers.

Simply download and register

Anyone can register and use the ForteBank application without being a customer of ForteBank. Simply by downloading and registering online, the application enables its users to transfer money from card to card and pay for the services for more than 300 providers. Users can also send money to a mobile phone number and receive money for a card or withdraw cash without the need of a ForteBank ATM card. ForteBank application enables its users to set auto-payments for more than 100 service providers.

On Hand 24/7

ForteBank is a mobile banking solution helping its users to manage their finances quickly and properly. Through the application, users have 24-hour unlimited access to banking services. They are able to perform various banking transactions at any location, at any time. Users can view their account balances, receive statements, replenish deposits, repay loans, pay for services of numerous suppliers and taxes, make payments to the budget, and make cash transfers to name a few. They can perform transactions as templates and easily repeat them in the future.

Augmented Reality and Talkin Chatbot

ForteBank knows that its customers are modern and tech-savvy. Technology is part of their daily lives and they access it from a range of devices, including mobile phones, tablets, and personal computers. Therefore, Fortebank leveraged Augmented Reality (AR) and TalkIn chatbot in order to meet the needs of digitally-connected customers as it provided a secure and easy way to manage money on-the-go. And became the very first bank in Kazakhstan to introduce AR and chatbot in a mobile banking app.

The AR feature allows the user to scan their bank card and automatically transfer their bank details into the app. All they have to do is to follow the directions of Fortebank’s hamster mascot. It is as simple as that!

The TalkIN chatbot is personified as the ForteBank mascot and accompanies customers throughout the whole app as a virtual assistant. It responds to voice commands and can answer a range of questions, from banking to personal, such as “How is the weather in Astana today?”. Current ForteBank customers can also chat with each other through TalkIN on the app.

Integrating Apple Pay for Contactless Payment

Payments became much more convenient with the arrival of contactless solutions especially with the shift in consumer payment preferences due to the COVID-19 pandemic.

Apple has already introduced contactless payment via Apple devices for easier and faster transactions. Thanks to Apple Pay, users can simply use their mobile phones or Apple devices to make a payment without ever taking their card out of their wallets. Lately, the increasing popularity of contactless payment solutions among consumers led banks to fast adoption of these new technologies. Thus, ForteBank wanted to become one of the first adopters of this technology in Kazakhstan to make banking convenient, user-friendly, and accessible for their customers. And we helped them smoothly implement Apple Pay integration.

Contactless mobile payment via Apple Pay is available for all Fortebank customers using iOS mobile devices. Consumers can securely use Apple Pay by registering their credit or virtual cards through Fortebank mobile app. With this integration, as well as providing a competitive advantage for our client we’ve also enhanced customer experience of tech savvy users of the bank by enabling them reach easy and secure mobile payment solutions.

Key Results

ForteBank’s collaboration with Commencis has resulted in significant improvements in digital banking transformation. The newly developed mobile banking platform saw increased user engagement, with a notable rise in digital transactions and user registrations. The integration of AR and the TalkIn chatbot improved customer interaction and service accessibility, while Apple Pay significantly boosted contactless payments. These advancements enhanced customer satisfaction and positioned ForteBank as a forward-thinking player in Kazakhstan’s banking industry.