Digital wallets: what are they, and why are they so popular?

Digital wallets: what are they, and why are they so popular?

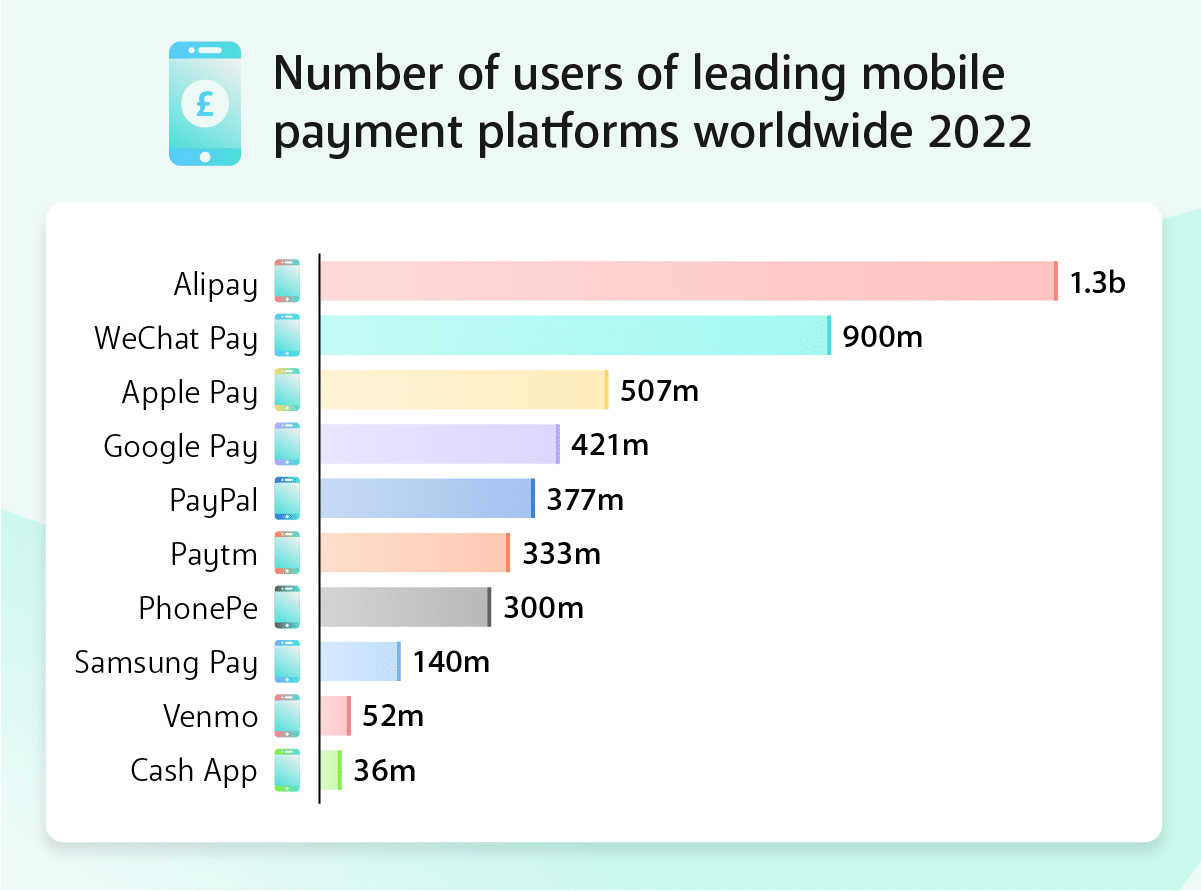

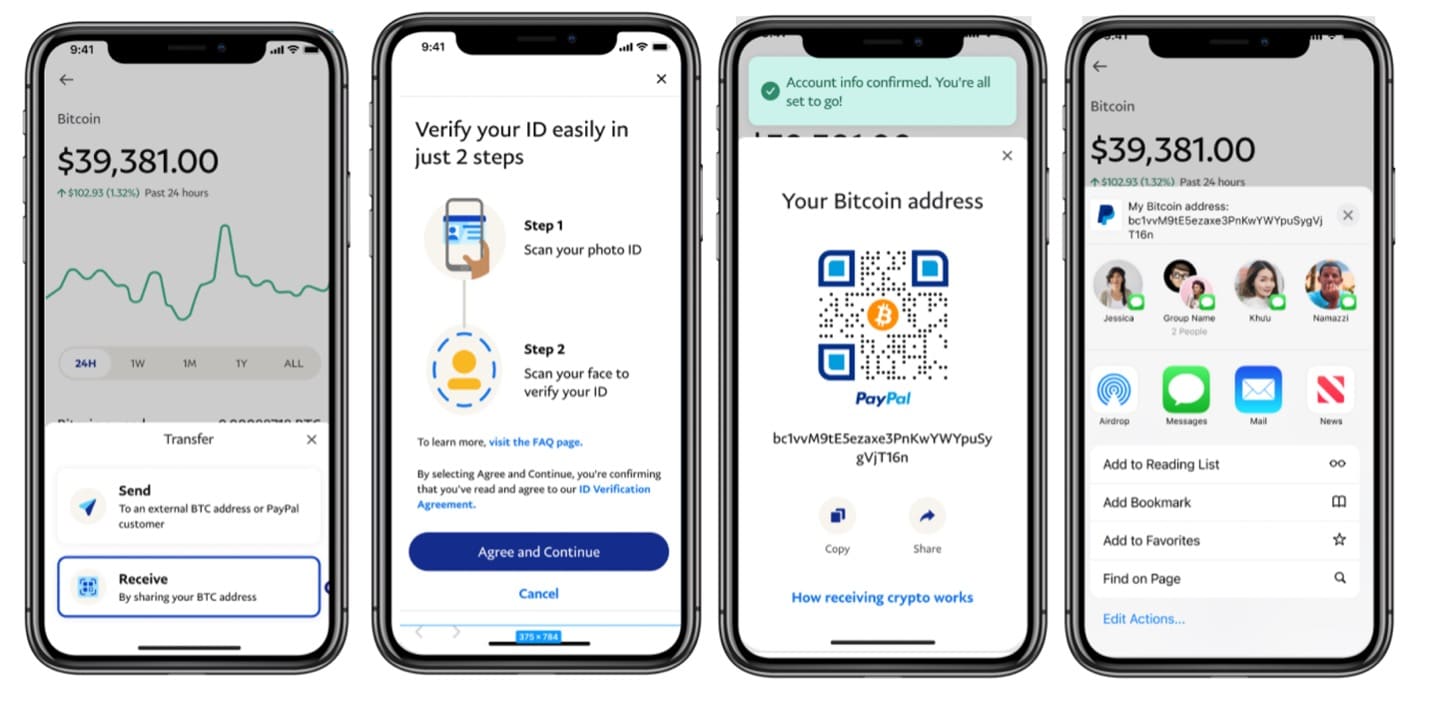

While you may not know exactly what digital wallets are, we’re sure you’ve heard of things like PayPal, Venmo, Apple Pay, Google Wallet, and Square Cash – even if just through spam emails and things like that. Well, these are simply examples of some of the most popular digital wallets around these days.

What exactly are digital wallets?

Digital wallets, also known as e-wallets, are digital applications or services that allow individuals to store, manage and use digital currency. These wallets can be used to securely store various forms of digital currency, including cryptocurrencies, as well as more traditional forms of currency like dollars or euros. And of course unlike normal cold hard cash, all mobile payments are by definition contactless payments with a digital wallet.

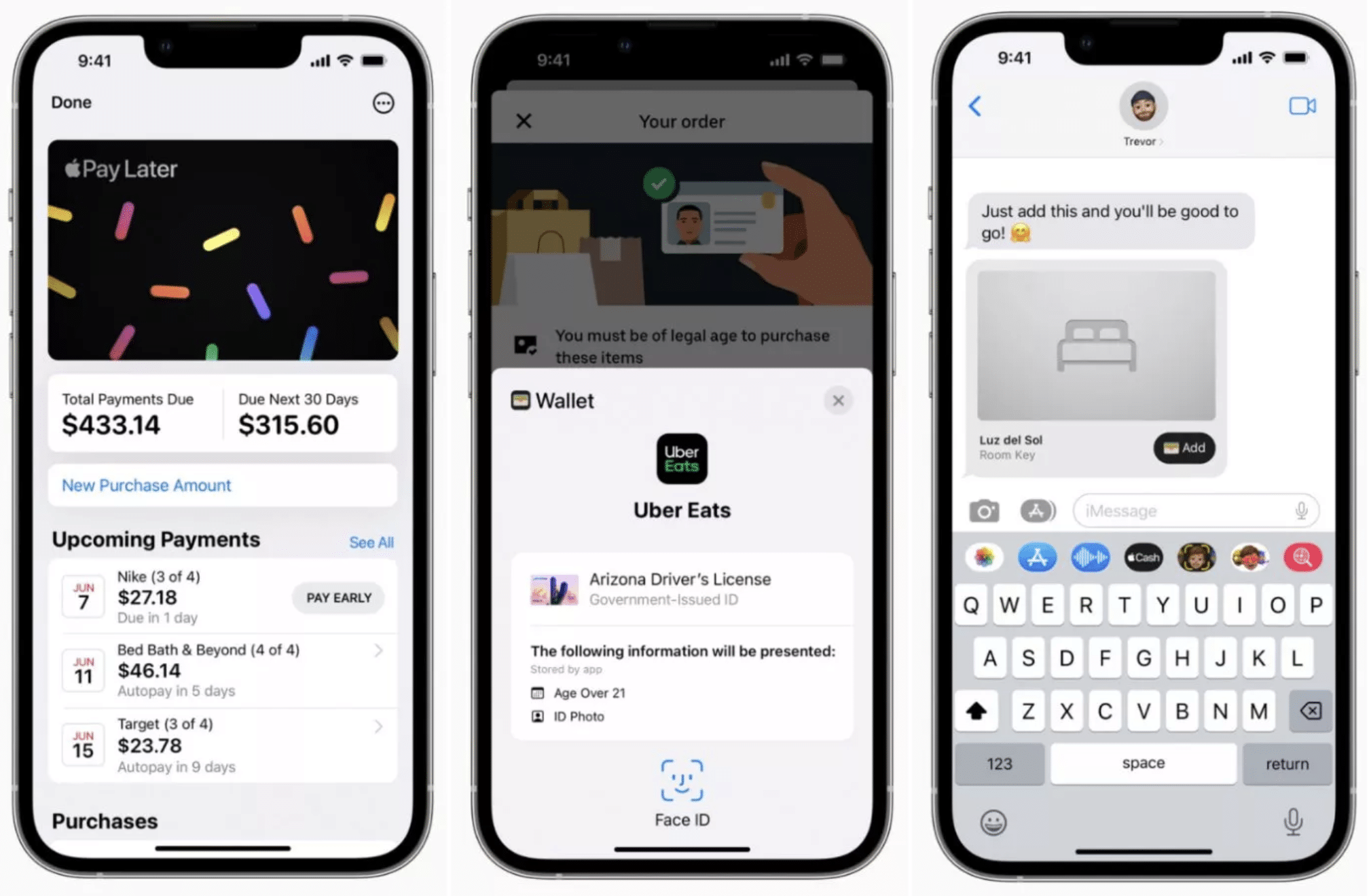

Since they’re online, obviously digital wallets need to be slightly more secure than just your typical password. That’s why they typically use encryption technology to secure transactions, and they often require users to authenticate themselves through a password or biometric identification such as fingerprint or facial recognition. Once the wallet is set up and loaded with currency, users can use it to make purchases online or in-store, transfer funds to other users, or pay bills and other expenses.

Types of digital wallets

Closed Wallets, Semi-Closed Wallets, and Open Wallets are terms commonly used in digital payments and mobile wallets. Here are brief definitions of each:

1. Closed Wallets

A closed wallet is a digital payment system where money can only be used to purchase goods and services from the company or entity that issued the wallet. These wallets are usually owned and operated by a single company or entity, such as a retailer or a telecom operator. They are not interoperable with other payment systems. Examples include Ola Money and Amazon Pay.

2. Semi-Closed Wallets

A semi-closed wallet is a digital payment system that can be used to purchase goods and services at merchants that have a contract with the wallet provider. They are not interoperable with other semi-closed wallets or bank accounts. Users can add money to their wallet from their bank account, credit or debit card, or other sources, but cannot withdraw cash from it. Paytm Wallet is an example of a semi-closed wallet.

3. Open Wallets

An open wallet is a digital payment system that allows users to make payments and transfer money to other users, regardless of the wallet provider. Open wallets are interoperable with other payment systems, such as bank accounts, credit or debit cards, and other wallets. Users can add money to the wallet and withdraw it from their bank account or other payment systems.

In summary, closed wallets are limited to purchases from a specific company or entity, semi-closed wallets are restricted to specific merchants but allow for adding funds, and open wallets allow for payments and transfers to other users and are interoperable with other payment systems.

The Rise of Digital Wallets

The rise of digital wallets naturally follows the rise of the digital age in general. As cell phone usage has boomed and people have become more and more comfortable with performing all of their transactions on their phones, it’s only natural that people would grow more comfortable with storing digital currency.

Like other digital features we’ve allowed into our lives, digital wallets are significantly more convenient. They’re easily accessible from a smartphone, laptop or tablet, so you can manage your funds and make transactions from anywhere with an internet connection. You don’t need to carry physical cash or cards around, reducing the risk of loss, theft or misplacement.

A lot of these conveniences hold for cryptocurrency as well, and obviously the simultaneous rise of cryptocurrency is one of the reasons that the use of digital wallets has grown as well. With two-factor authentication and other payment security features, you could easily argue that digital wallets are actually more secure than paper money any thief could steal out of your pocket.

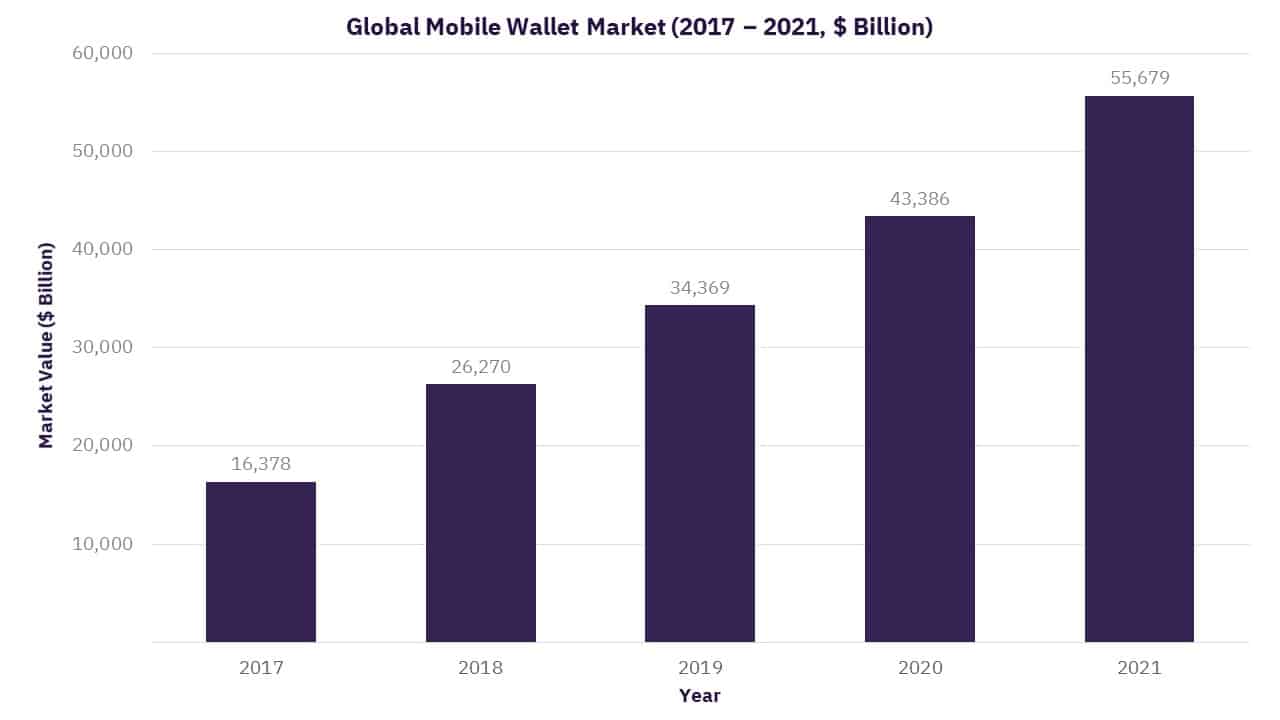

As you can see, the global digital wallet market has been skyrocketing in recent years, and it’s expected to reach $12.6 trillion by 2027.

Do I Need a Digital Wallet?

Obviously whether you need to get a digital wallet is a personal decision that only you can make. But essentially if you’re someone who values convenience, security, and ease of use in your payment methods, a digital wallet may be the best option for you. We’ve already gone over how digital wallets are typically amongst the most convenient and secure methods of payment.

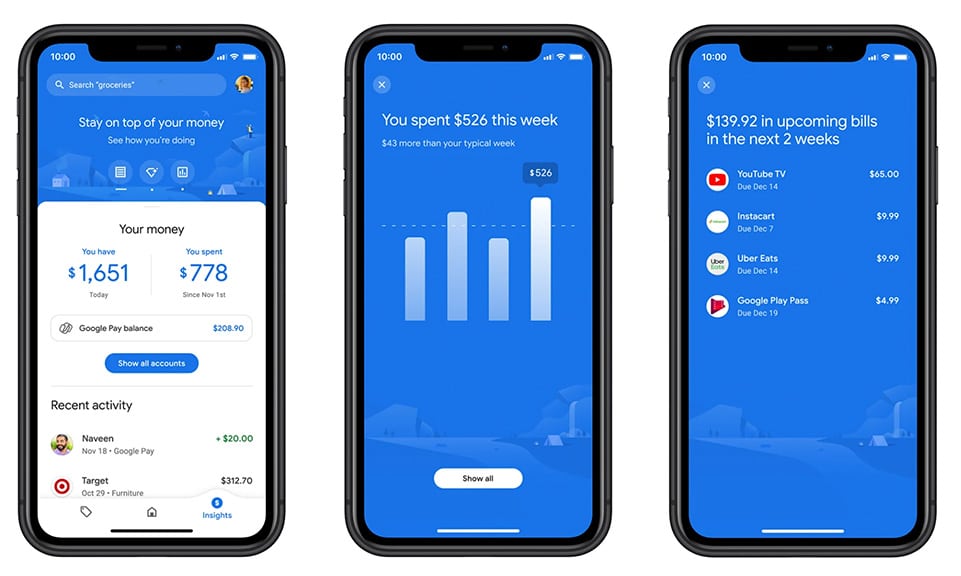

Another way they’re helpful for people who need to keep track of how much they spend. Digital wallets can help you keep track of your spending by providing a detailed transaction history, real-time account balance, budgeting features, and integration with personal finance apps. This can help you make better financial decisions and stay on top of your finances.

For example, in collaboration with Commencis, Batelco offers Beyon Money, a mobile wallet service. Users of the Beyon Money app can use their mobile devices to send and receive digital payments and mobile payments, buy goods and services, and transfer money. Also, the app has functions including top-up services, deposit account as known as Flexi Saving. Beyon Money also provides other security elements, like two-factor authentication and biometric verification, to guarantee secure transactions.

Which Digital Wallet should I Choose?

There are loads of digital wallets to choose from, but the most popular outside of China are PayPal, Google Pay, Apple Pay, Samsung Pay, Venmo, and Square Cash.

Choosing the one that works best for you can be tricky, but there are a few tips and tricks to help you along.

-

Are you primarily an Android, Apple, Or Samsung user?

This one is easy. If you are already wedded to one of these products, then Google Pay, Apple Pay, and Samsung Pay respectively should be the digital wallet for you. Moreover, all three offer rewards programs and cashback when you use their digital wallet for transactions, a nice bonus if you can get it!

-

If you’re a small business owner

Venmo and Square Cash offer a Business Profile feature that allows small business owners to accept payments from customers easily. This is quite a nice option for anyone who wants to avoid the hassle of setting up a traditional payment gateway or merchant account.

-

If you’re an online shopper

PayPal is perhaps the most widely accepted digital wallet by online retailers and marketplaces, making it a convenient option if you frequently shop online. It allows you to securely store your payment information and make purchases with just a few clicks.

-

If you are traveling to different countries regularly

Again, PayPal is available in 200 countries and supports multiple currencies, making it a good option for international transactions. It also offers competitive exchange rates and low fees for international transactions.

-

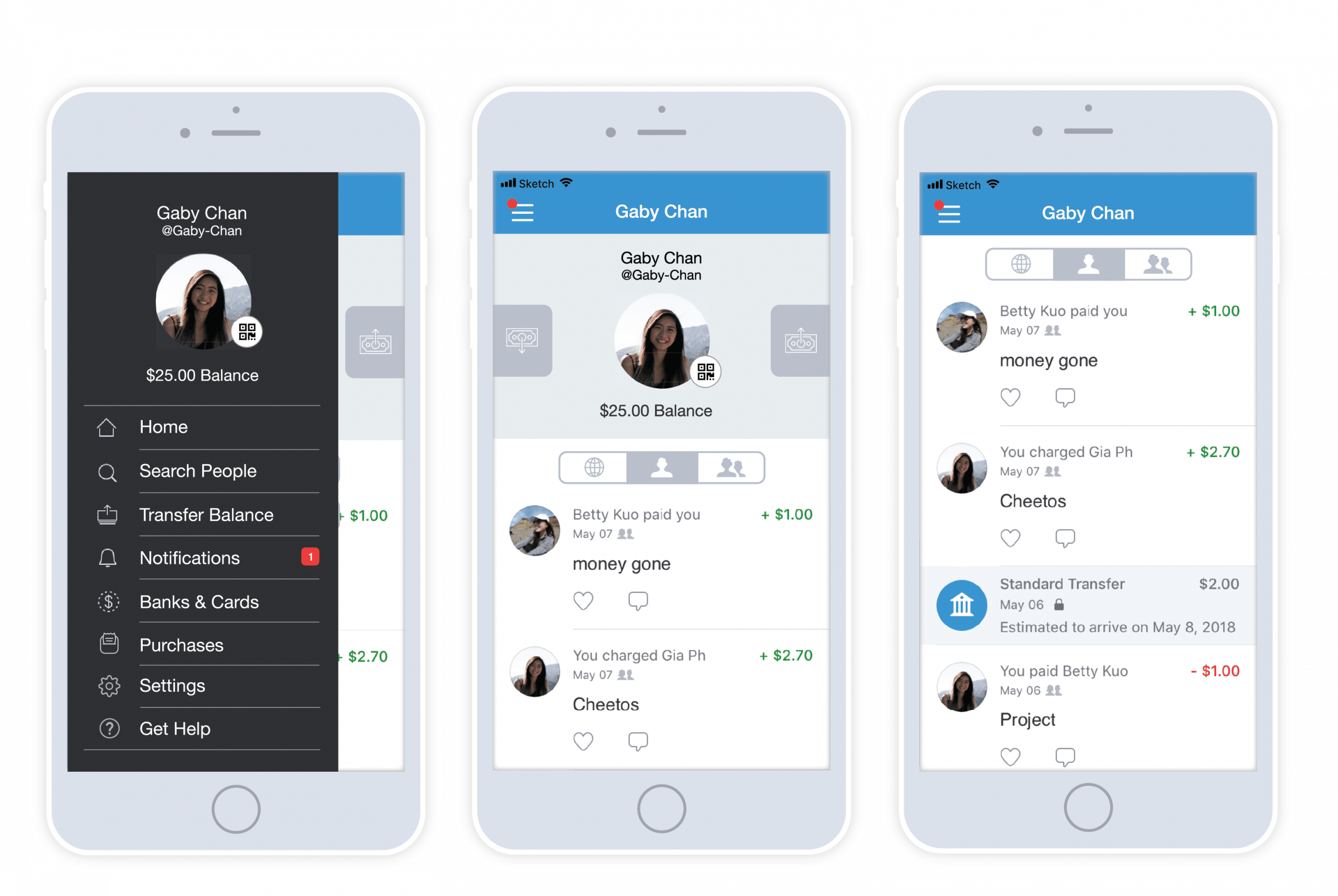

If social payments are important to you

Venmo is designed with social payments in mind, allowing you to send and receive money from friends and family members easily. You can also comment on digital payments and share them with your social network, making it a great option for those who like to split bills or send money for shared expenses.

The most popular digital wallets

PayPal

One of the most widely used digital wallets, PayPal allows users to make online payments, send and receive money, and transfer funds between bank accounts.

Google Pay

Google Pay is a digital wallet and payment system that allows users to make purchases in-store, online, and in-app using their smartphone or wearable device.

Apple Pay

Apple Pay is a mobile payment and digital wallet service that allows users to make purchases with their iPhone, iPad, or Apple Watch in-store, online, and in-app.

Venmo

Venmo is a popular digital wallet that allows users to send and receive money from friends and family, as well as make online purchases and pay bills.

Digital Wallets in Turkey

There are several digital wallets available in Turkey. Here are some examples.

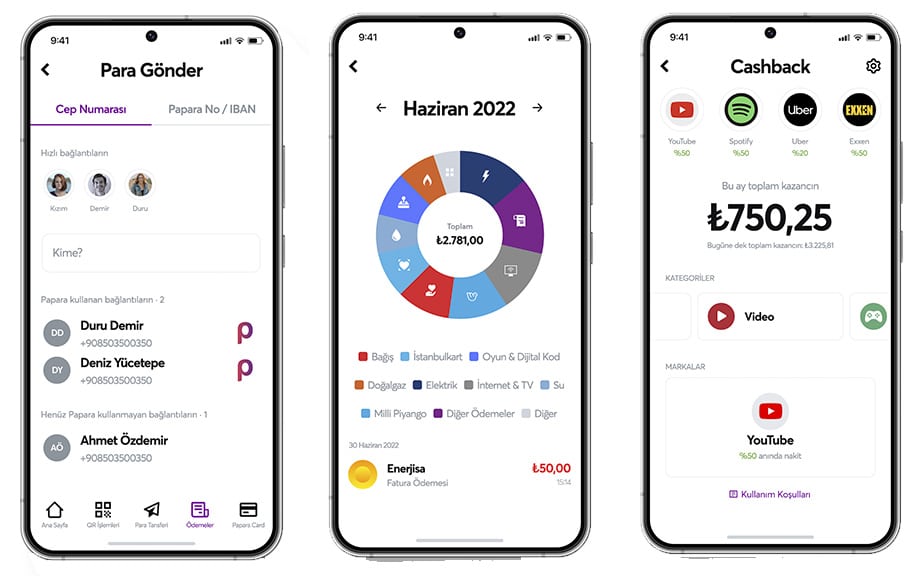

Papara

A popular digital wallet in Turkey that allows users to send and receive money, pay bills, and make online purchases.

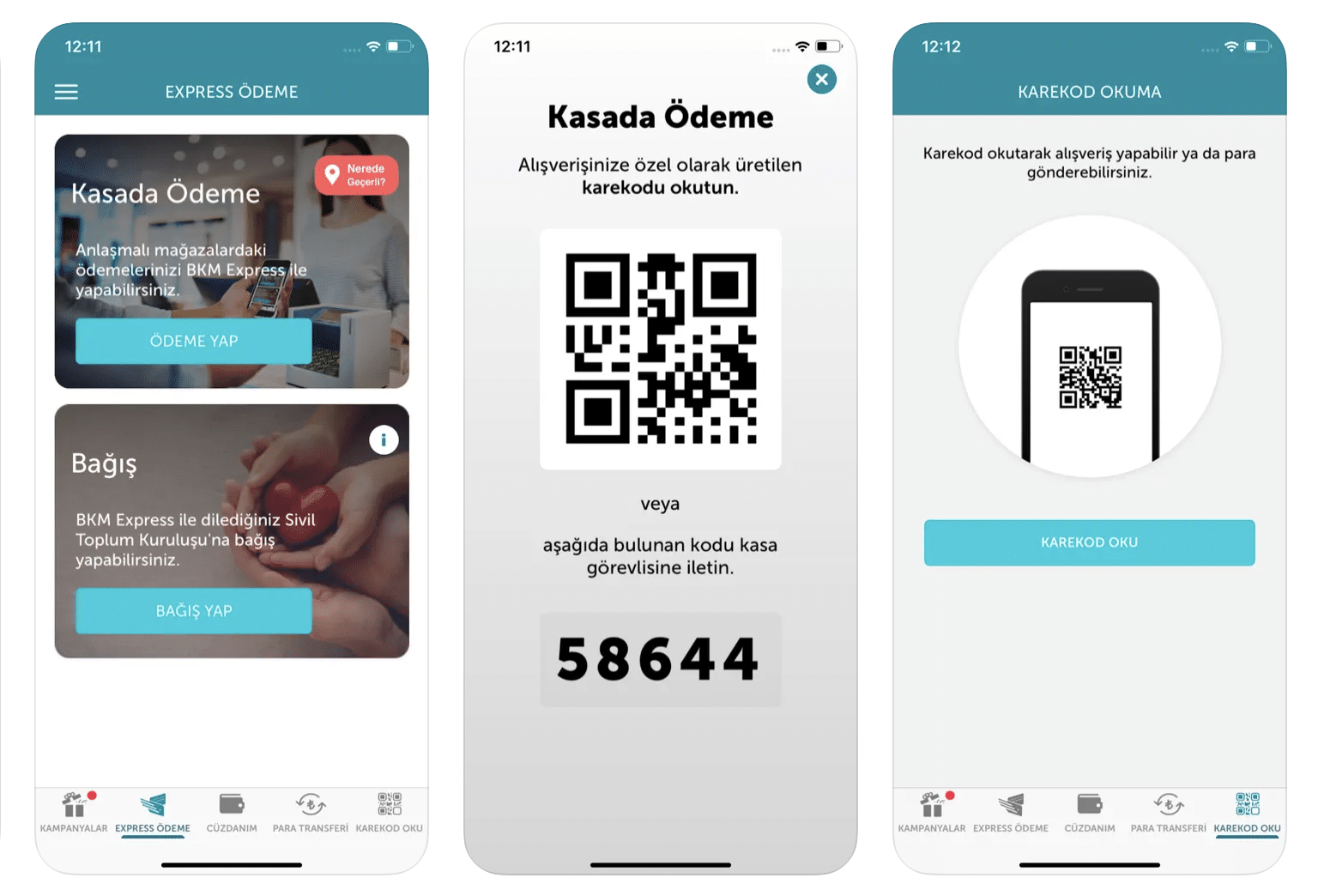

BKM Express

A digital wallet and payment platform that allows users to make purchases at online and offline merchants, as well as send and receive money.

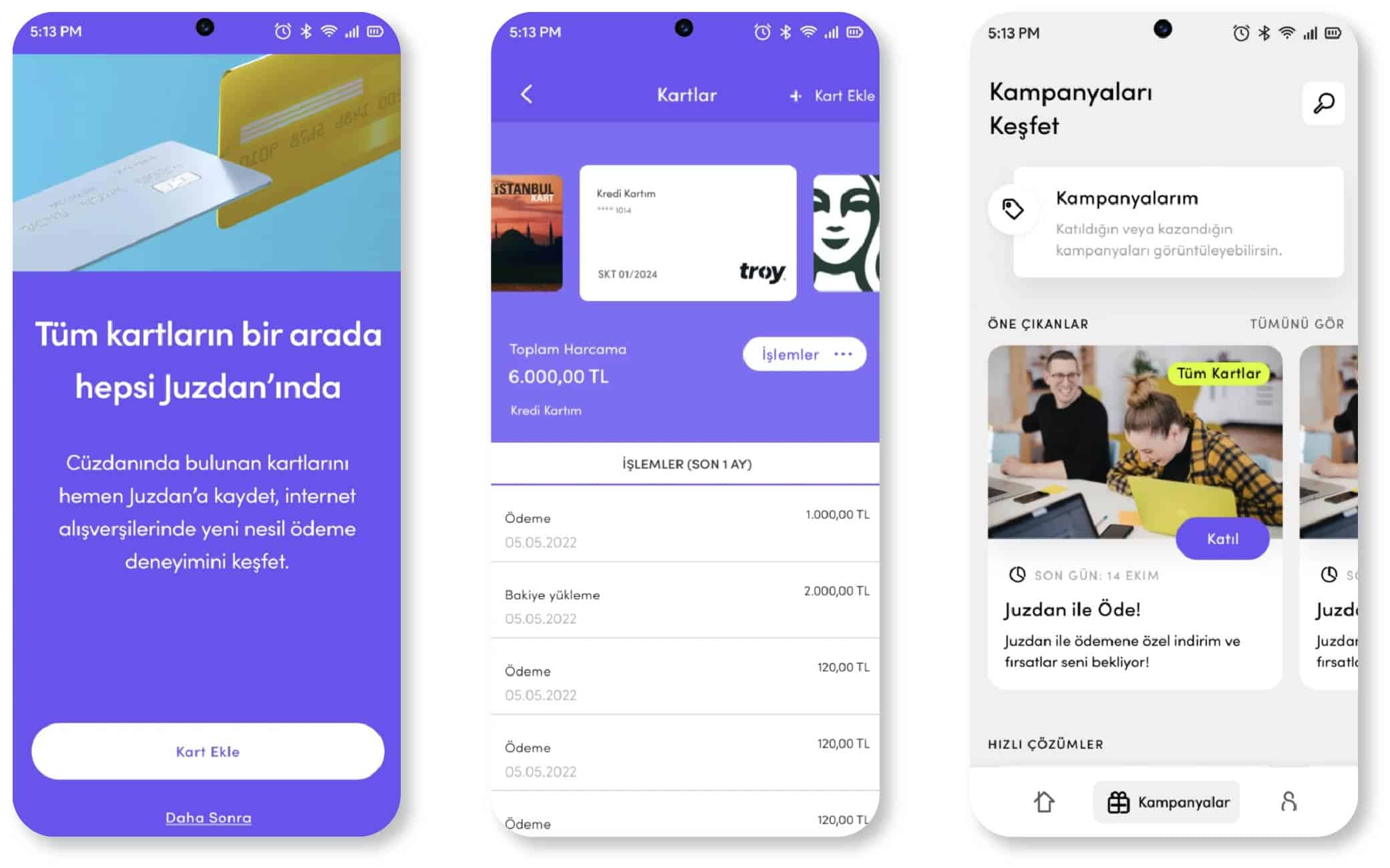

Akbank Juzdan

A mobile banking application that includes a digital wallet feature, allowing users to make payments, money transfers, and manage their bank accounts and cards.

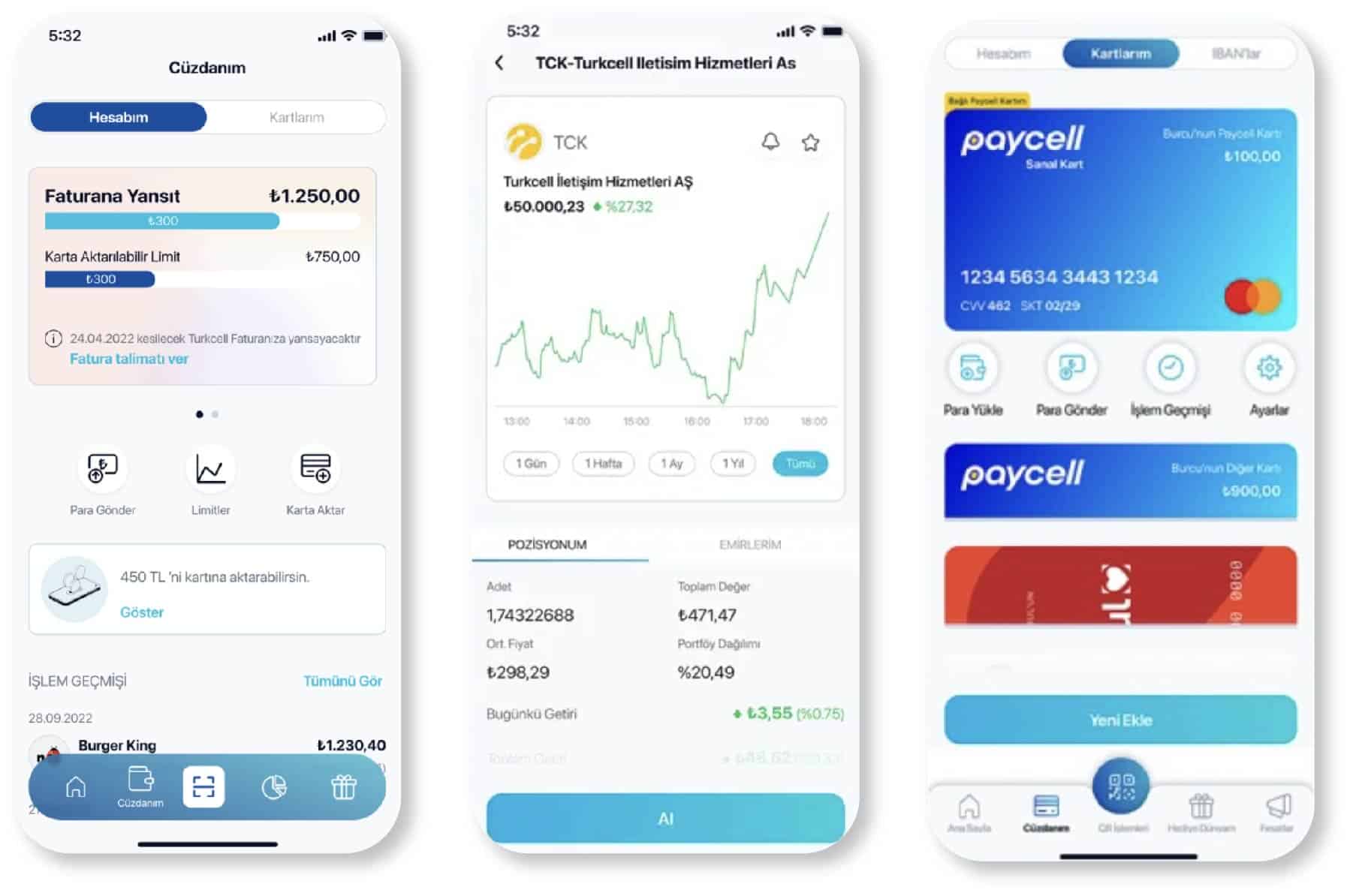

Paycell

A digital wallet and payment platform that allows users to make purchases at online and offline merchants, as well as send and receive money.

Key Takeaways

Digital wallets are growing increasingly popular and increasingly common in today’s digitalized world. They make transactions faster, easier, and more convenient and come with a number of critical security features that means your money is safer than ever before. There are a number of different kinds of digital wallets, and the kind that might be right for you might not be the same as one for other people. But regardless, in today’s world that’s moving ever faster towards becoming a completely cashless society, having a digital wallet is probably the right decision, regardless of what you plan on using it for.

Reading Time: 7 minutes

Don’t miss out the latestCommencis Thoughts and News.