Turkey’s banking sector is entering a new phase of digital transformation, driven by shifting customer expectations, regulatory developments, and rapid advances in AI and digital technologies. This shift is redefining how banks engage customers and deliver services.

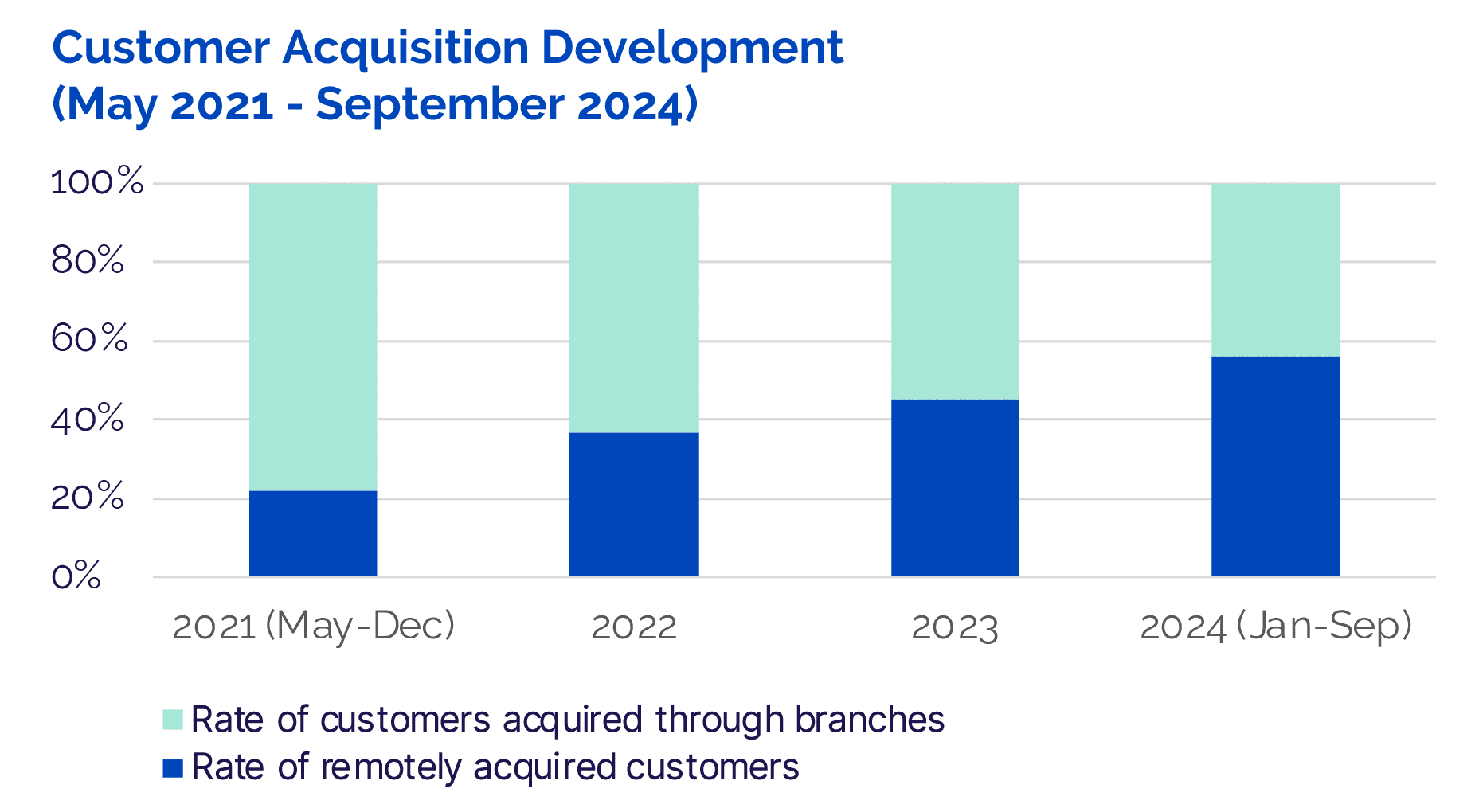

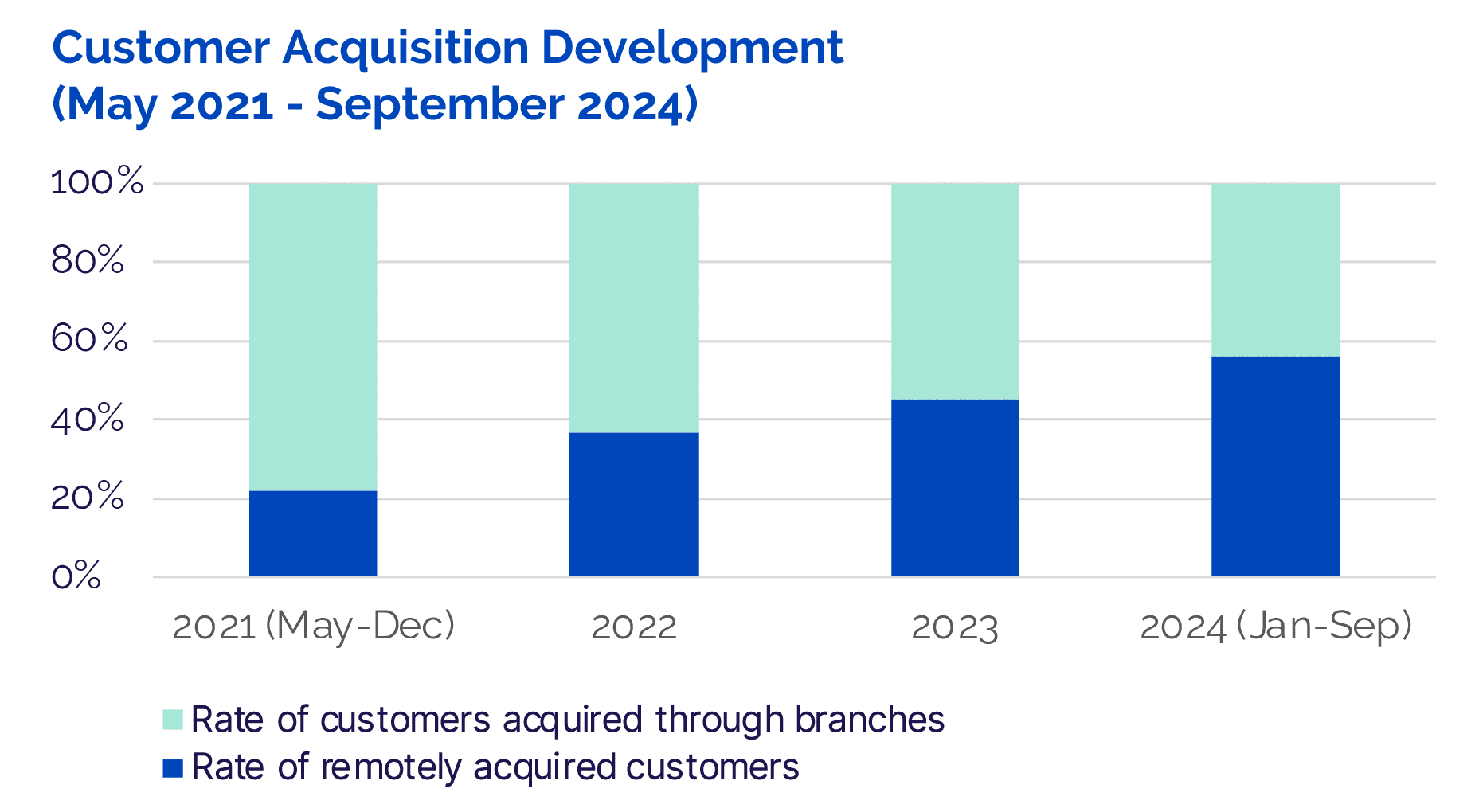

84%

growth in Turkey’s digital banking users (Q4 2020–Q1 2025)

111%

increase in remote customer acquisition in Turkey (2021–2024)

Digital Onboarding Is Becoming the Default

Remote customer acquisition has become the primary driver of customer growth in Turkey, signaling a decisive shift toward digital onboarding.

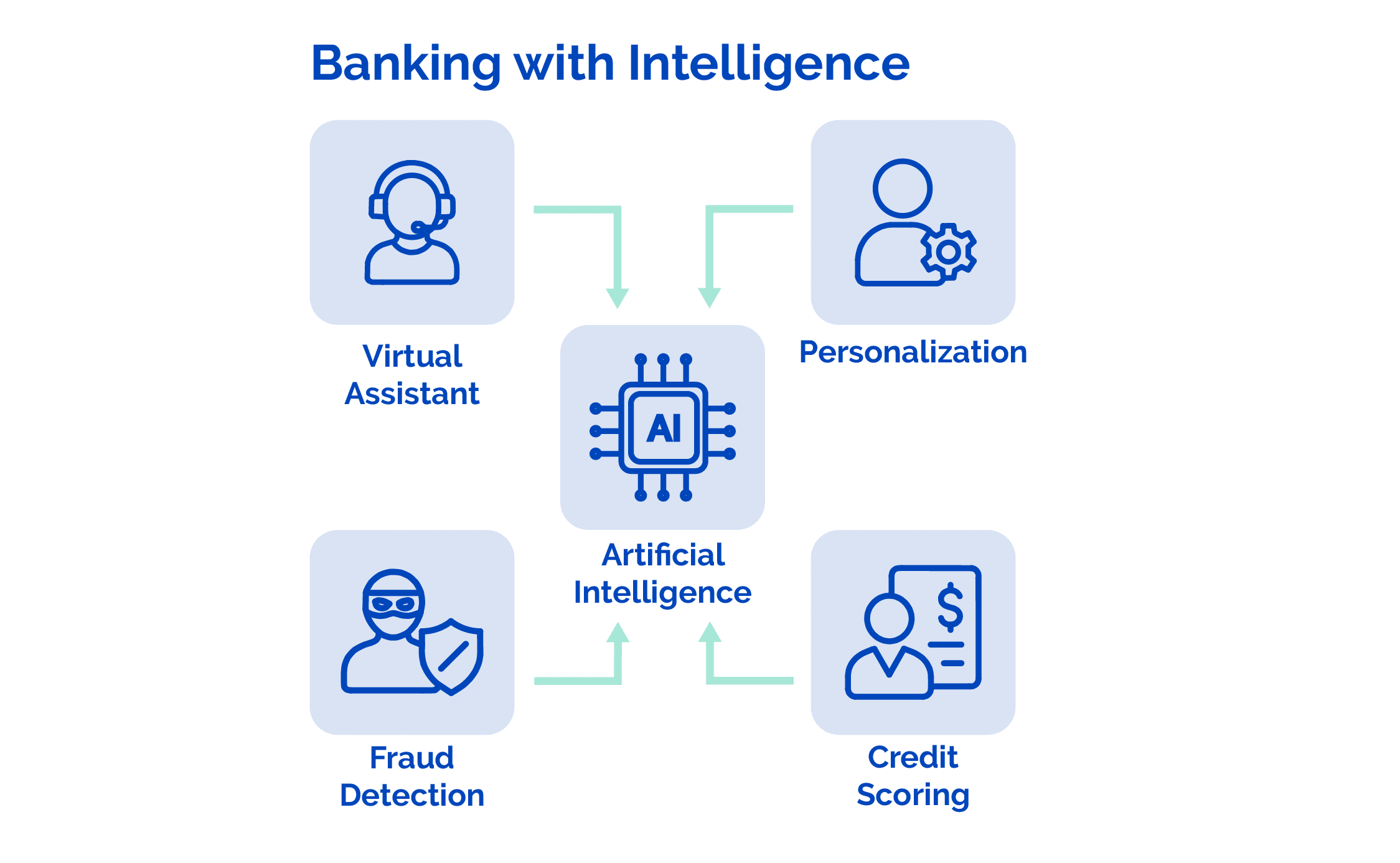

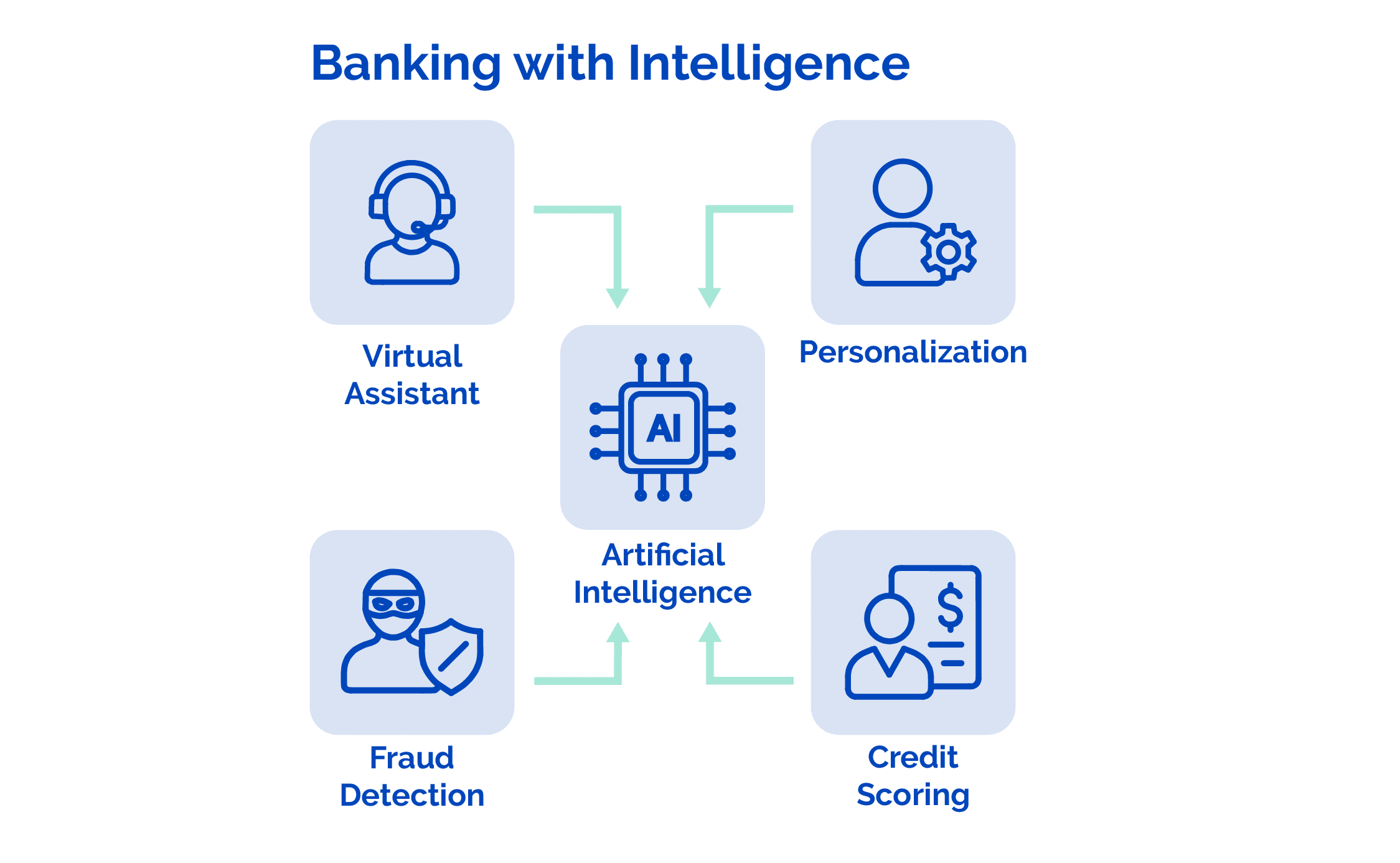

AI Is Moving Beyond Chatbots

AI in banking is evolving from basic chatbots into intelligent systems that can understand intent and take action. These AI-driven experiences are becoming a core part of digital banking journeys, enabling faster and more seamless customer interactions.

Digital Onboarding Is Becoming the Default

Remote customer acquisition has become the primary driver of customer growth in Turkey, signaling a decisive shift toward digital onboarding.

AI Is Moving Beyond Chatbots

AI in banking is evolving from basic chatbots into intelligent systems that can understand intent and take action. These AI-driven experiences are becoming a core part of digital banking journeys, enabling faster and more seamless customer interactions.

What’s Inside

1. The Fintech Pulse of Turkish Banking

1.1 Digital Onboarding Becoming Standard Practice

1.2 Embedded Finance: Extending Banking Beyond the Bank

1.3 BNPL in Action: Credit Without Calling It Credit

1.4 Sustainability That Lives Inside the App

1.5 Banking with Intelligence: The Expanding Role of AI

2. Trends Shaping Traditional Banking

2.1 Digitizing the Bank from Within

2.2 Becoming a Super App and Delivering a Personalized Experience

2.3 Open Innovation Through the Fintech Ecosystem

2.4 Open Banking and Regulatory Readiness

3. Trends Shaping New Generation Banking

3.1 Attractive Product Offers

3.2 Mobile First, UX Driven Design

3.3 Fast Launches and High Agility Powered by Modular Systems

3.4 Targeting with Focus: Understanding the New Audience

4. Evolving Paths: Looking Ahead for Traditional and New Generation Banks